Date: 15 Mar, 2024

Domestic Updates

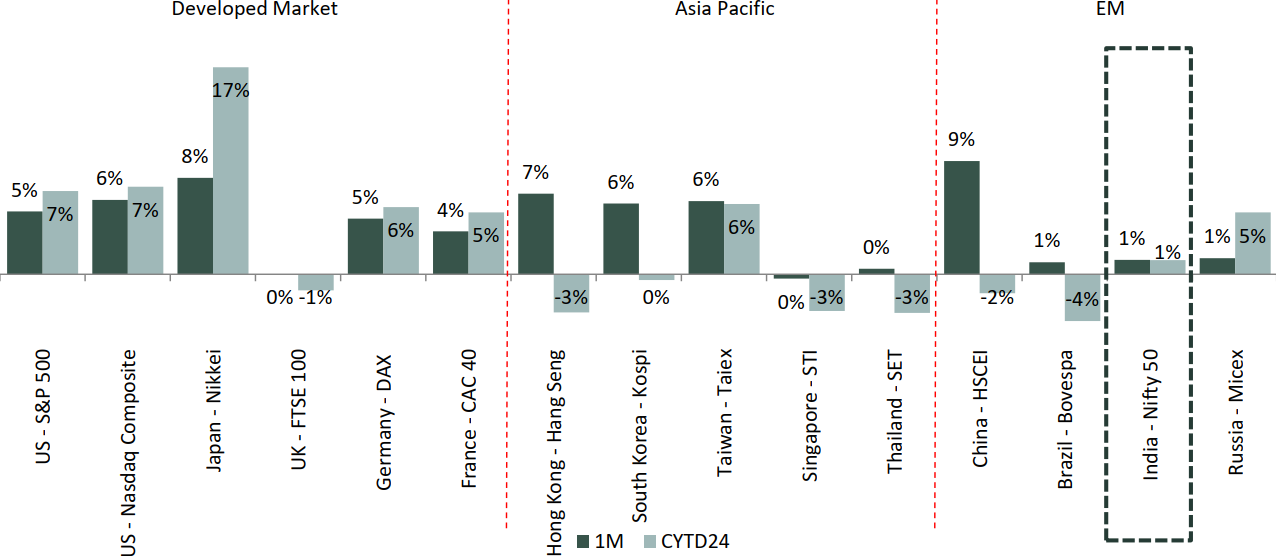

February saw a global market rally defying initial concerns about recessions in the EU and Japan. This optimism stemmed from expectations of interest rates reaching their peak and potentially dipping in the future. While major markets like the US surged significantly, India's performance was relatively muted at around 1%. This can be attributed to several factors, including: Valuation concerns, FII outflows and Preelection caution. Furthermore, the performance of mid and small-cap companies lagged behind their large-cap counterparts. This discrepancy can be linked to the premium valuation of these smaller companies. The NSE Mid Cap 100, for example, was trading at a significant 30% premium compared to the Nifty-50, making them less attractive to investors seeking value.

Source - 1 IDBI Capital

The BSE500 presented a mixed picture in Q3FY24, with earnings growth defying expectations and outperforming the moderate 3% YoY increase in revenue (excluding BFSI). This positive outcome can be attributed to successful margin expansion efforts across various sectors. Several sectors emerged as clear winners. Automobiles, Banks, Retail, and Transportation witnessed healthy revenue growth, indicating strong performance in these areas. Notably, the BFSI and Auto sectors spearheaded the earnings surge, boasting impressive 22% and 59% YoY growth, respectively. The O&G sector also joined the positive trend, fuelled by a 40% YoY jump primarily driven by the robust profitability of OMCs due to favourable marketing margins. While the earnings performance was encouraging, concerns remain regarding consumption demand. It's important to note that the earnings growth was not evenly distributed. A select group of heavyweight companies, including IOC, HDFC Bank, TTMT, GAIL, and Adani Power, contributed significantly, accounting for 33% of the incremental YoY earnings growth during the quarter. Looking beyond the top performers, the broader picture reveals that 329 companies out of the 496 reporting firms witnessed earnings growth. However, 167 companies still faced a decline or loss in Q3FY24. Encouragingly, 251 companies managed to achieve an impressive over 15% YoY growth in their earnings, demonstrating resilience within the broader market. The gradual recovery of consumption demand is anticipated over the next 2-4 quarters. This, coupled with the continued strength in select sectors, could paint a brighter picture for the overall performance of the BSE500 in the coming quarters.

Foreign investors took a wait-and-see approach in February 2024, contributing only USD 0.5 billion in net inflows. This stands in stark contrast to the consistent buying by domestic institutional investors (DIIs), who have now recorded seven consecutive months of inflows, totaling USD 3.1 billion in February. Looking at the year-to-date (YTD) picture, the trend is even clearer. Foreign investors have pulled out a net of USD 2.7 billion from Indian equities in CY24YTD, a significant reversal compared to the USD 21.4 billion they infused in CY23. Meanwhile, DIIs have continued to be steadfast supporters, pouring in USD 6.3 billion YTD, compared to USD 22.3 billion in CY23. This shift in investor sentiment can be attributed to several factors that make India an increasingly attractive investment destination: strong corporate profits, stable domestic conditions, controlled inflation and stable political environment. With these factors continuing to hold strong, DIIs are expected to remain a reliable source of liquidity for the Indian equity market, while foreign investors may become more selective in their investments as they navigate global uncertainties.

The Indian bond yield closed at 7.1% vs. the US bond yield of 4.3% in Feb’24. The yield spread contracted MoM, but has still been at the lowest level since Jun’06. Further, Bloomberg Index Services said on Tuesday it would include in its Emerging Market Local Currency Index from Jan. 31 next year 34 Indian government bonds eligible for investment via the country's fully accessible route (FAR). The inclusion of these bonds will be phased in over a 10-month period starting on the rebalance date of January 31, 2025. This decision coming after the decision of JP Morgan to include India in the JP Morgan’s Emerging Market Bond Index, is a vote of confidence in the Indian economy. Inclusion of India in the Bloomberg Bond Index is expected to attract investment exceeding $5 billion. This comes on top of the expected investment of around $20 billion in the JP Morgan EM Bond Fund. At that point, the Indian rupee is expected to become the third largest currency component of the Bloomberg Emerging Market Local Currency Index, following the Chinese renminbi and the South Korean won.

Macro Update

While India's Q3 GDP growth exceeded expectations at 8.4%, a closer look reveals a mixed picture. This growth primarily stemmed from investments, which surged to a six-quarter high of 12.2%. However, both private consumption and government spending remained subdued, growing at a tepid 3.5% and contracting by 3.2% year-on-year, respectively. This disparity raises concerns. The robust headline growth might mask the underlying weakness in domestic demand. While the investment rate has improved, it's crucial to understand how much of this is driven by private companies (capex) and not solely by government spending. A continued reliance on the latter could pose a challenge for long-term sustainability.

Inflation cooled slightly in January 2024, reaching 5.1% year-on-year, down from 5.7% in December 2023. However, this figure was still above both market expectations (5%). While food inflation eased significantly, falling from 9.5% to 8.3% year-on-year, core inflation (excluding food and fuel) continued its downward trend, reaching 3.6%. Notably, all major sub-components of core inflation, except for education, saw a further decrease in January.

India's central bank maintained its wait-and-see stance for the sixth consecutive time, keeping the key repo rate unchanged at 6.5%. This decision reflects the bank's concerns about ensuring complete transmission of past rate hikes and bringing inflation down to a sustainable level. While growth is expected to remain robust at 7% in FY25, driven by factors like government spending, domestic consumption, and corporate profits, the inflation outlook is cautiously optimistic. The RBI forecasts a decline in inflation to 4.5% in FY25 from 5.4% in FY24, attributing this to a positive agricultural season and expectations of normal monsoon rains. Based on these factors, we don't anticipate any change in the central bank's policy stance before August 2024.

India's industrial production (IIP) inched up to 3.8% in December 2023, exceeding both market expectations (2%) and the previous month's growth of 2.4%. This improvement was largely driven by a surge in the manufacturing sector, which grew by 3.9% compared to 1.2% in November. It's important to note that manufacturing holds a significant weight of over 77% in the IIP index. However, growth in the mining and electricity sectors moderated in December. The mining sector grew by 5.1%, down from 7.0% in November, while the electricity sector saw a growth of just 1.2%, compared to 5.8% in the previous month. Encouragingly, 18 out of 23 sub-sectors within the manufacturing category witnessed growth improvements compared to November, indicating positive momentum in this crucial sector.

International Updates

Despite news on recession in EU and Japan, equities in developed market has continued on its bull run in Feb-24. Equity market hit bottom 2-3 quarters before actual recession and thus market has priced in the Feb-24 news on the recession. Japan was up 8% and US based S&P 500 and Nasdaq was up by +5% MoM and +6% MoM respectively in Feb-24. On rates cut, given strong US economic data, markets have moderated its outlook on rate cut to 3-4 cut in CY24 vs 6-7 cut earlier in the US. With slower than anticipated moderation in the US economy, uncertainty around the timing and quantum of Fed rate cuts has increased. However, as more indicators (retail sales, labour market, consumer confidence, home sales) have begun showing some softening at the start of Q1CY24, there exists ~62% chance of rate cut by Fed in Jun’24. In Eurozone, a rate cut is expected to come in earlier (Apr’24) in the wake of faltering growth. ECB had expected 0.6% growth in CY23, but it came in flat (0%). Contraction in German economy (-0.3% in CY23) was a major drag. In China as well, economic growth remains fragile, as official manufacturing PMI indicates that large industries continue to underperform (compared with smaller export-oriented companies covered in Markit survey). US GDP growth in Q4CY23 has been revised slightly lower to 3.2% from 3.3% estimated earlier, on account of downward revision to private inventory investment. Eurozone’s manufacturing PMI showed that while activity continues to remain weak, the pace of deterioration softened in Feb’24, as index settled at 46.5 compared with 46.6 in Jan’24. The drag mainly came from its largest economy—Germany where the index declined to 4-month low of 42.5 from 45.5 in Jan’24. China’s official manufacturing PMI inched down in Feb’24 to 49.1 from 49.2 in Jan’24, reflecting the impact of Lunar New Year holiday season. The dip was due to steeper decline in new export orders (index at 46.3 versus 47.2).

Rockstud Capital Market Outlook

Nifty after consolidating in January 24, it continued to exhibit volatility with benchmark oscillating in a wide range (~767 points) to close the month of February with a gain of 257 points up 1.2%. While markets have been concern about high inflation and interest rate trajectory globally, slowing growth in developed markets and recent Red sea crises, however India’s strong economic growth, 3QFY24 corporate earnings ending broadly in line with market estimates, moderate inflation and strong retail participation led Indian markets to sustain at higher levels. In short run while markets continue to see movements based on liquidity and news flows, we believe that India is in a sweet spot where economic growth is set to accelerate and expect the same would be reflected in equity returns. In CY23 India is expected to contributed 16% of world GDP and on track to become third largest economy by 2028. Through our YUVA Bharat PMS strategy, we endeavour to participate in India growth story

Equity markets benchmark Nifty now trades at a 12-month forward P/E of 19.5x, near its long period average. India is benefiting from both macro and micro tailwinds moderating inflation, easing G Sec, stable currency and resilient corporate earnings. With election round the corner and no near-term trigger, we may see a range bound market in short term. We anticipate continued optimism in the market and any major correction as an opportunity to increase allocation. We believe Time in market is more important than timing the market from long term wealth creation.

Portfolio Commentary

Yuva Bharat Portfolio consist of 17 stocks as of 29th February 24.

During the month we exited from Prince Pipes & Fittings Ltd on back results below expectations, even management admitted to loosing market share and would take 2 quarters to regain market share.

We have added 3 stocks to portfolio Welspun Living Ltd, Lemon Tree Hotels Ltd and Protean eGov Technologies Ltd.

Welspun Living Ltd is expected to gain from free trade agreement expected to be signed between India and UK and European Union. Along with its domestic retail gaining scale and has started contributing positively at EBITA level.

Lemon Tree Hotels Ltd is seeing the benefit of resumption of leisure and corporate domestic travel, its newly launched hotel near Mumbai airport “Aurika” its largest and premium offering is likely to result in improvement in average revenue per room and being premium property thereby improving EBIDTA margin.

Protean eGov Technologies is pure play on rapid digital transformation underway in India, it has leadership position in 2 E Gov platform; Tax Information Portal (PAN, Aadhar, TAN, GST Returns) and Central Record Keeping for National Pension Scheme and Atal Pension Yojna and it provides Identification services like PAN and TAN issuance, e-KYc, esign, e authentication. In each of the services it has largest and formidable market share. It is now working on developing 4 more platform Cloud, Open digital ecosystem and data analytics and aggregator and replicating model in international markets.

Unaudited Performance data for the Portfolio Manager and Investment Approach provided above is not verified by any regulatory authority or SEBI and past performance may or may not be sustained in the future. The performance is based on TWRR as of February 29, 2024. Inception Date is August 02, 2023. As per SEBI guidelines, returns are net of all expenses and investor returns may differ, based on their period of investment, fee structure, and point of capital flows. Please note that the performance of your portfolio may vary from that of other investors and that generated by the Investment Approach across all investors because of 1) the timing of inflows and outflows of funds; and 2) differences in the portfolio composition because of restrictions and other constraints.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.