Date: 19 Apr, 2024

Domestic Updates

India capped off a stellar financial year (FY24) with a booming economy and thriving stock market. The GDP is estimated to reach $3.6 trillion, growing by a robust 7.6% or more. Equity markets delivered impressive returns, with Nifty, Nifty Midcap 100, and Nifty Smallcap 100 generating gains of 29%, 60%, and 70% respectively. This performance propelled India's market capitalization to $4.4 trillion, solidifying its position as the world's fifth largest. Key indices like Nifty 50 and BSE Sensex shattered records, breaching 22,000 and 74,000 marks, respectively. March witnessed a surge in activity, fueled by positive global cues and a shift in foreign investor sentiment, with net buying exceeding Rs. 29,000 crore. This bullish trend encompassed various sectors, including capital goods, automobiles, financials, telecom, and real estate. While a slight pullback occurred towards the month's end, overall activity remained significantly higher compared to the previous two months.

Source - 1 IDBI Capital

Indian markets continued to see strong investor interest in March 2024. Domestic investors poured in a record $6.8 billion, marking their eighth consecutive month of net inflows. This is the highest level since April 2020. Foreign investors (FIIs) also contributed $4 billion in March, but their year-to-date inflows remain subdued at $1.4 billion compared to $21.4 billion in the same period last year. This shift in investor focus is likely due to India's growing appeal as an investment destination, driven by factors like healthy corporate profits, domestic stability, controlled inflation, and a predictable political environment. As these positive factors persist, domestic investors are expected to continue fueling the Indian equity market, while foreign investors might adopt a more cautious approach amidst global uncertainties. March 2024 saw Indian G-Sec yields end 3 basis points lower at 7.05%, reflecting a confluence of favorable market conditions. Echoing global trends, expectations of a rate cut by the U.S. Federal Reserve later this year fueled a decrease in U.S. Treasury yields, which in turn, positively impacted Indian G-Secs. Additionally, a recent decline in bond prices triggered value buying by investors, further driving yields downward. The Indian government's planned borrowing for the first half of the year came in substantially lower than anticipated, adding another layer of support to the yield curve.

Macro Update

India's current account deficit (CAD) narrowed slightly in Q3FY24 to $10.5 billion (1.2% of GDP), compared to $11.4 billion (1.3% of GDP) in Q2FY24. This improvement came despite a wider trade gap, thanks to a boost in income from services and transfers (invisible flows). Year-over-year, both exports and imports showed growth. Capital inflows also rose to $17.4 billion from $13.0 billion in Q2FY24, driven by increased foreign investment and bank activity. India's inclusion in the JP Morgan GBI-EM index significantly boosted net foreign portfolio investment (FPI) to $12.0 billion in Q3FY24, up from $4.9 billion in Q2FY24. Looking ahead, we expect the CAD to narrow further in Q4FY24 as exports outperform expectations. Encouragingly, January and February 2024 export figures came in higher than predicted, even though year-to-date exports still lag behind the previous year. Furthermore, service sector exports have remained strong despite global slowdown concerns.

Fueled by expectations of lower U.S. interest rates and its status as a safe-haven asset, gold prices soared to a new all-time high above $2,300 per ounce. Since interest rates and gold prices typically move in opposite directions, a decrease in rates makes gold more attractive compared to fixed-income investments like bonds, which offer lower returns in such an environment. This surge in demand is further bolstered by central bank purchases, with emerging markets like China and India leading the charge. Furthermore, safe-haven buying intensified after Israel's attack on Iran's Syrian embassy, which resulted in the deaths of two Iranian generals. China's insatiable appetite for gold jewelry is another factor driving prices. According to the World Gold Council, China dethroned India as the world's top buyer in 2023, purchasing a staggering 603 tons of gold jewelry, a 10% increase from the previous year. Conversely, India's gold jewelry consumption witnessed a 6% decline in 2023, dropping to 562.3 tons.

CPI inflation was flat at 5.10% in Feb sequentially. Retail inflation was marginally higher than our estimate of 5.0% as food inflation continues to be sticky. Headline WPI eased to 0.2% in Feb’24 from 0.3% in Jan’24, coming in lower than street estimate of 0.5%. This was despite pick up seen in food inflation which inched up by 4.1% in Feb’24, versus 3.8% in Jan’24. While headline inflation gauges like CPI and WPI showed some mixed signals, core inflation, which excludes volatile food and energy prices, provided a clearer picture. Core inflation dipped to a multi-year low of 3.30% in February, down from 3.60% in January. This suggests that underlying demand pressures in the economy remain subdued, giving the RBI some breathing room to maintain its accommodative monetary policy stance.

The Monetary Policy Committee (MPC) entered the fiscal year FY25 maintaining the existing rates and policy stance, supported by a 5:1 majority vote. While there were minor adjustments to growth and inflation forecasts, projections indicate that inflation is anticipated to stay above the 4% threshold throughout FY25, except for a temporary dip to 3.8% in Q2. The anticipation of improved rural consumption coinciding with a normal monsoon is countered by concerns about potential adverse effects of high temperatures on the rural economy. The governor reiterated the risks associated with elevated debt levels in developed economies and the possibility of inflationary pressures reemerging. Despite this, the governor emphasized that higher real rates should not be seen as excessively restrictive, given the persistent elevated inflation in the near future. Overcoming the final stages of disinflation presents a challenge, pushing back the timeline for further policy easing beyond June 2024. It is anticipated that the Reserve Bank of India (RBI) will maintain an actively disinflationary monetary policy until inflation stabilizes at the targeted 4% level in a sustainable manner.

India's manufacturing sector boomed in March 2024, reaching a 16-year high according to the Purchasing Managers' Index (PMI) of 59.1. This surge reflects a significant increase in new orders, output, and stockpiles of materials, along with a return to job growth. Strong demand and limited production capacity led to a rise in input costs in March. New export orders grew at their fastest pace since May 2022. The services sector also thrived, with the Services Business Activity Index hitting a 13-year high of 61.2 in March 2024. This growth is attributed to healthy demand, improved efficiency, and positive sales trends.

International Updates

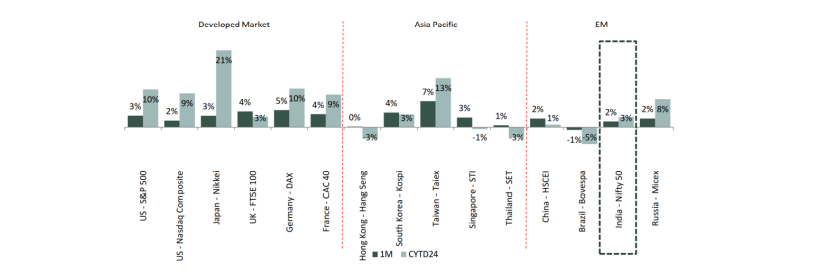

US stock indices edged higher as most megacap stocks and chipmakers jumped on optimism over three interest rate cuts this year. Wall Street's main indexes gained ahead of more commentary from Jerome Powell after the Federal Reserve chair stuck to the script overnight by saying the central bank still expects to cut rates later this year. On other end, Japan’s benchmark stock market index has smashed the 40,000 mark for the first time, continuing its comeback after decades of stagnation as the country’s inflation accelerated in February. Japanese stocks have become some of the hottest buys over the past year as foreign investors take advantage of the cheap yen and corporate governance reforms that have boosted shareholder returns.

Major European indices notched their fifth consecutive monthly gains, refreshing their record-highs in March, thanks to the ongoing optimism about potential rate cuts by central banks this year on the back of cooling inflation. The FTSE 100 jumped to its highest level since May as investors cheered the prospects of earlier interest rate cuts. The Index also rose following news of UK’s economy’s return to growth at the beginning of 2024. Corporate earnings also contributed to the positive sentiment in the markets.

The US economy shows more strength than expected:

Mixed signals in manufacturing:

Rockstud Capital Market Outlook

The Nifty closed higher for the second successive month ending 1.6% higher MoM at 22327. FY24 was a remarkable year for the Indian equity market, Mid and Smallcap indices rallied by 60% and 63% respectively while the Largecap Nifty 50 went up by 28.6% over the same period. India is estimated exit FY24 with a GDP of USD3.6t (growth of 7.6%), one of the fastest growing nation in world and on track to become third largest economy by 2028. We believe India is currently enjoying the confluence of the best macro and micro tailwinds, such as moderating inflation, range-bound crude prices, easing 10-year G-sec yield, stable currency, and resilient corporate earnings. Markets, in near term will be driven by “narrative” based on 1) Lok Sabha election outcome, 2) Macroeconomic developments, 3) Q4FY24 earning season, 4) Direction of bond yields and 5) Oil prices & dollar index. Through our YUVA Bharat PMS strategy, we endeavour to participate in India growth story.

Equity markets benchmark Nifty now trades at a 12-month forward P/E of 19.4x, near its long period average. Indian economy continues to be a ‘star performing’ economy as against other emerging markets. Moreover, we believe that it is likely to continue its growth momentum and remain stable against the backdrop of a volatile global economy. With election round the corner and no near-term trigger, we may see a range bound market in short term. We anticipate continued optimism in the market and any major correction as an opportunity to increase allocation.We believe Time in market is more important than timing the market from long term wealth creation.

Portfolio Commentary

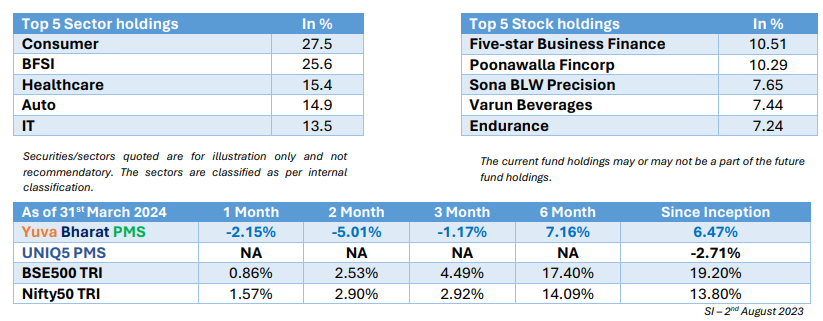

Yuva Bharat Portfolio consist of 16 stocks as of 31st March.

During the month we exited from IDFC Ltd as we see continued pressure on NIM due to higher interest rate to continue thus delaying the improvement in ROA trajectory.

Also, during the month, we realigned allocation within portfolio whereby BFSI sector allocation was reduced and allocation in Auto, Healthcare and IT were increased.

We’re pleased to introduce UNIQ5!

Are you looking for Absolute Returns?

Rockstud Capital is proud to unveil the Customised Discretionary PMS -UNIQ5, a comprehensive product designed to market savvy investors is a customised bouquet of ideas tailored to client’s appetite for generating absolute returns. To know more contact us.

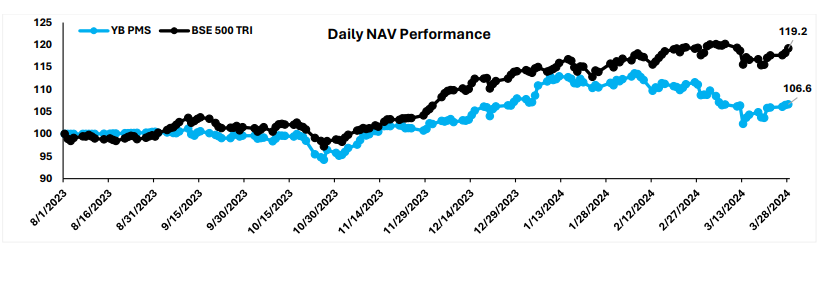

Portfolio Attributes & Performance

Unaudited Performance data for the Portfolio Manager and Investment Approach provided above is not verified by any regulatory authority or SEBI and past performance may or may not be sustained in the future. The performance is based on TWRR as of March 31st , 2024. Inception Date is August 02, 2023. As per SEBI guidelines, returns are net of all expenses and investor returns may differ, based on their period of investment, fee structure, and point of capital flows. Please note that the performance of your portfolio may vary from that of other investors and that generated by the Investment Approach across all investors because of 1) the timing of inflows and outflows of funds; and 2) differences in the portfolio composition because of restrictions and other constraints.

Disclaimer

Disclaimer

General Risk Factors:

General Disclaimers:

Regulatory Disclosures:

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.