Date: 29 Jan, 2024

RC Thoughts

Indian startup ecosystem in 2023 had learnings of building resilience and think longterm approach. These are early signs where we see the startup ecosystem overall going towards Horizon 3, a stage where innovation is driven by sustenance over disruption, driven by fundamentals of profit building, customer acquisition with longevity, more omni channel then one stream of business scaling, expanding to more grass roots in India then just targeting Metro cities. A startup generation lasts for about 7-8 years before becoming an enterprise. India has seen this from 2008-2015(Horizon-1 focusing on core problems), 2016-2023(Horizon-2, growth hungry with disruptions) and now 2024-onwards we believe will be an Era of Horizon-3 where maturity with take center stage together with India centric innovation competing large global giants.

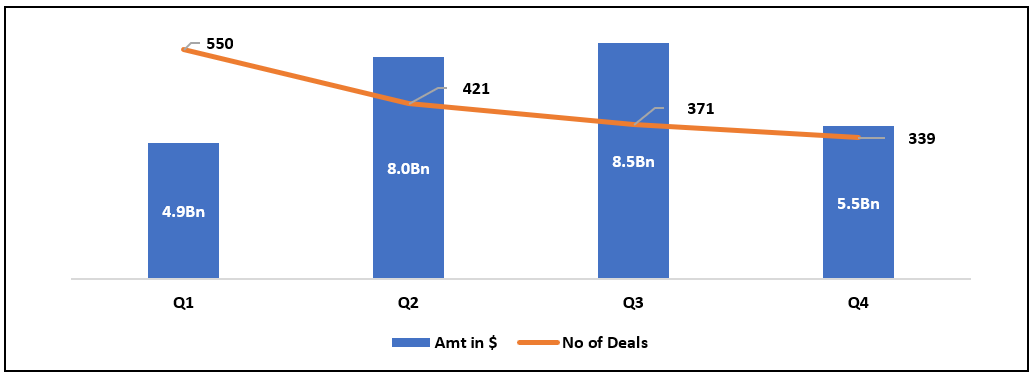

Startup Funding Scenario

Calendar Quarter-on-Quater Funding in 2023

(Amt in $ Billion)

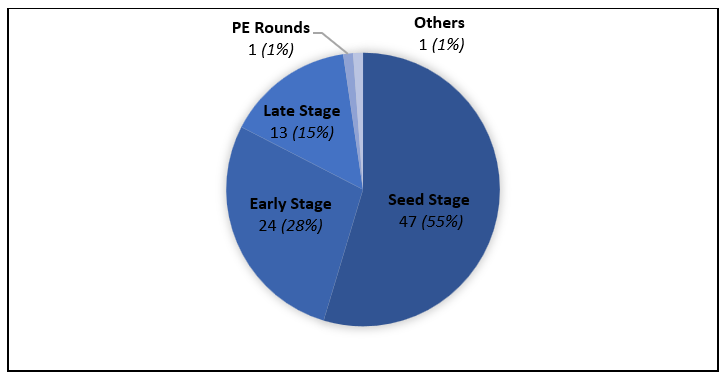

Stage-wise Funding in December 2023

Stage-wise Funding in December 2023

Other News

Other News

Vegrow, a business-to-business (B2B) start-up that uses technology to sell fruits, on Wednesday raised $46 million in a funding round led by GIC, Singapore’s sovereign wealth fund.

Existing investors Prosus Ventures, Matrix Partners India, Elevation Capital, and Lightspeed participated in the Series C round. Read Here

Agilitas Sports, founded by Abhishek Ganguly, the former Managing Director of Puma India and South-East Asia, has raised $12.5 million from Nexus Venture Partners. This funding is aimed at developing a range of consumer brands in the sports footwear and apparel sectors. Read Here

Exponent Energy raises $26.4 million in funding led by Eight Roads Ventures for breakthrough 15-minute EV charging tech. Exponent Energy plans to expand its offering in the electric three-wheeler (E3W) space and enter the intercity e-bus segment in 2024. Read Here

Direct-to-consumer mattress maker The Sleep Company raised $23 million in a Series C funding round, which was led by Premji Invests, and Fireside Ventures. Both Premji Invest and Fireside are among the investors in the company. This investment comes 12 months after their previous investments. Read Here

Ola Electric has filed its draft red herring prospectus with SEBI for an initial public offering (IPO). The IPO will comprise Rs 5,500 crore in a fresh issue and an offer for sale of more than 95 million shares. Of them, Co-founder and CEO Bhavish Aggarwal will offload 47.39 million shares at a face value of Rs 10. Read Here

RC Portfolio Companies Update

In less than a year, Everest Fleet doubles its commitment to Kolkata's green future with the grand opening of our second EV hub. Here's to rapid strides and eco-friendly rides! Look Here

Money Club, a deep tech group savings platform where users save money with other verified peers in government registered funds, allowing 400m lower middle-class Indians to save safely and securely, was featured in Hindustan Times as one of India's leading fintech trailblazers. Read Here

Bighaat, a global digital agri ecosystem, was ranked 7th of Deloitte India Technology Fast 50 programs, as it is a testament of our super-fast growth in terms of revenue over the last three years. Read Here

Pitch to Us/ Pitch to RC

If you're building something exciting that is catering to the youth of India then we would love to speak with you. Do reach out to us using the below link.

Link: https://bit.ly/RockstudCapitalPitchToUs

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.