Clear focus of stock universe – We focus on companies having market capitalisation upto Rs. 27,000 crs

“Too Hard” box – We focus on companies within our circle of competence

Management – Our understanding of management is based on certain factors such as quality of business strategy taken in the past, honesty and fairness in financial reporting and related party transactions

Growth visibility – We bet on companies across themes with visible growth in future through either capacity expansion, capacity ramp up, industry growth, scheme of arrangements, etc

Operational leverage – We focus on companies that are in margin expansion phase or contraction of expenses as % of sales due to economies of scale

Margin of safety – We gauge margin of safety by deciphering intrinsic value of company through our internal proprietary methodology

Clearly avoiding red flags – We flag out companies with risky parameters such as pledged shares, aggressive accounting policies, change in promoter holding, contingent liabilities and many more

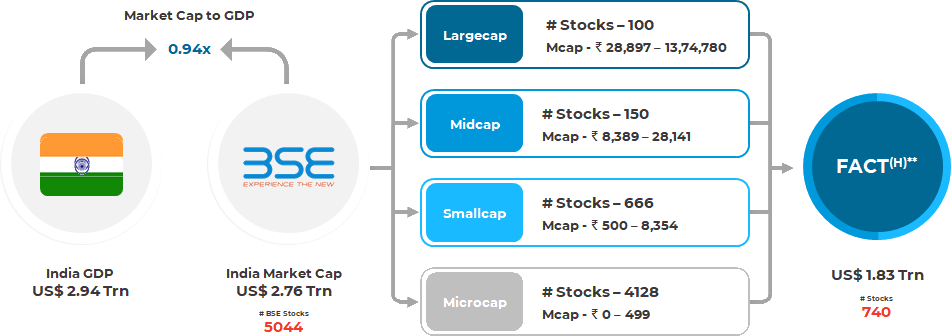

Rockstud Capital forays in theme-based approach to select high quality out performance in listed equity domain. We have coined an acronym FACTH (Financials, Agriculture, Consumption, Technology and Healthcare) to build our investment portfolio.

| Financials | Fastest Growing Economy | Low Credit to GDP Ratio | Huge Runway | Expanded Opportunities | Leading Sector |

|---|---|---|---|---|---|

| Agriculture | Largest Source of Livelihood | Lower Farm Mechanization | Government Thrust | Doubling Farmer’s Income | Animal Husbandry, Dairying & Fisheries |

| Consumption | Backbone of India Growth story | Structural factors | Under penetration | Supplemental opportunities | Emergence of E-retail |

| Technology | Resilient & Consistent Industry | Pillars of Modern India | Largest Offshoring Destination | Digital Hub of the World | Champion Services Sector |

| Healthcare | Strong positioning | Government’s initiatives | Increased diagnostics relevance | Doubling Farmer’s Income | Animal Husbandry, Dairying & Fisheries |