Date: 12 Apr, 2022

Zensar Technologies Ltd – Bet on digitization of businesses along with rising spend on cloud, artificial intelligence, data analytics, etc and emergence of new business models.

Zensar Technologies is our bet on a trend shift in businesses from traditional to transformational led by digitization along with rising spend on cloud, artificial intelligence, data analytics, etc and emergence of new business models. This was picked by our fund Rockstud Capital Investment Fund Series I around Rs. 320-350s in March 2022.

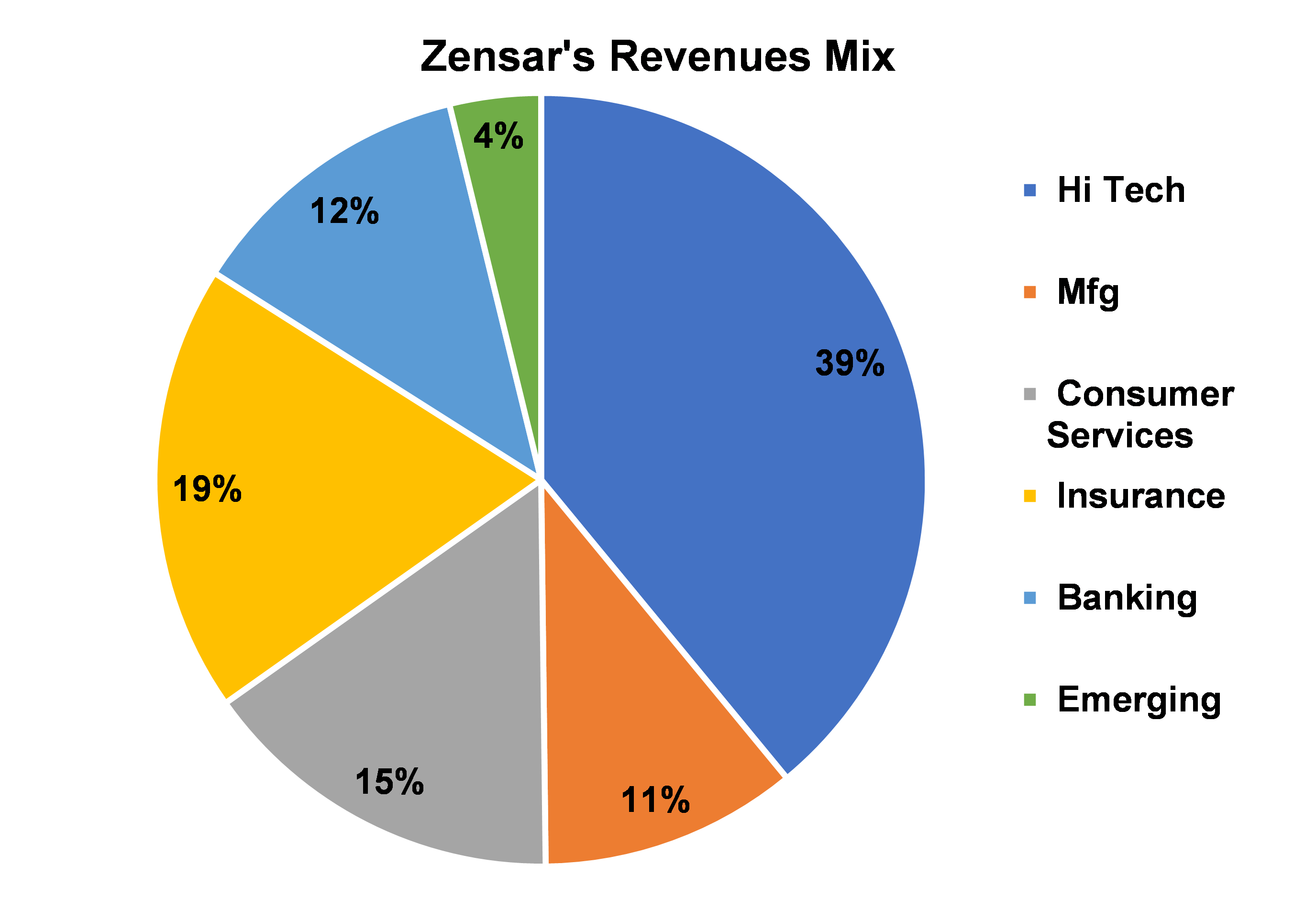

Company Brief – Zensar owned by Harsh Goenka group of company’s primary business involves providing digital and technology solutions to global customers. It provides application management (85% of revenue) and infrastructure management services (15% of revenue) to Manufacturing and Hitech industry (~40% of revenues), retail and financial account for (46.4% of revenues) and Emerging industries.

Application management service is an outsourcing task of providing ongoing support for apps to external provider i.e. IT cos that specializes in this type of maintenance and monitoring. This is across customer relationship management (CRM), content management system (CMS), enterprise resource planning (ERP) to business intelligence (BI).

Why we bought – Apart from financial parameters that we run across on quant below are some of the highlights which caught our attention for our investment.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.