Date: 10 Jul, 2023

Over the past decade, there has been a considerable surge in the number of young Indian businesses. With the rise of digital technologies and an increasing number of young entrepreneurs, India's startup ecosystem has grown rapidly and is now the 3rd largest in the world with 1,00,000+ registered startups, according to the Department for Promotion of Industry and Internal Trade (DPIIT).

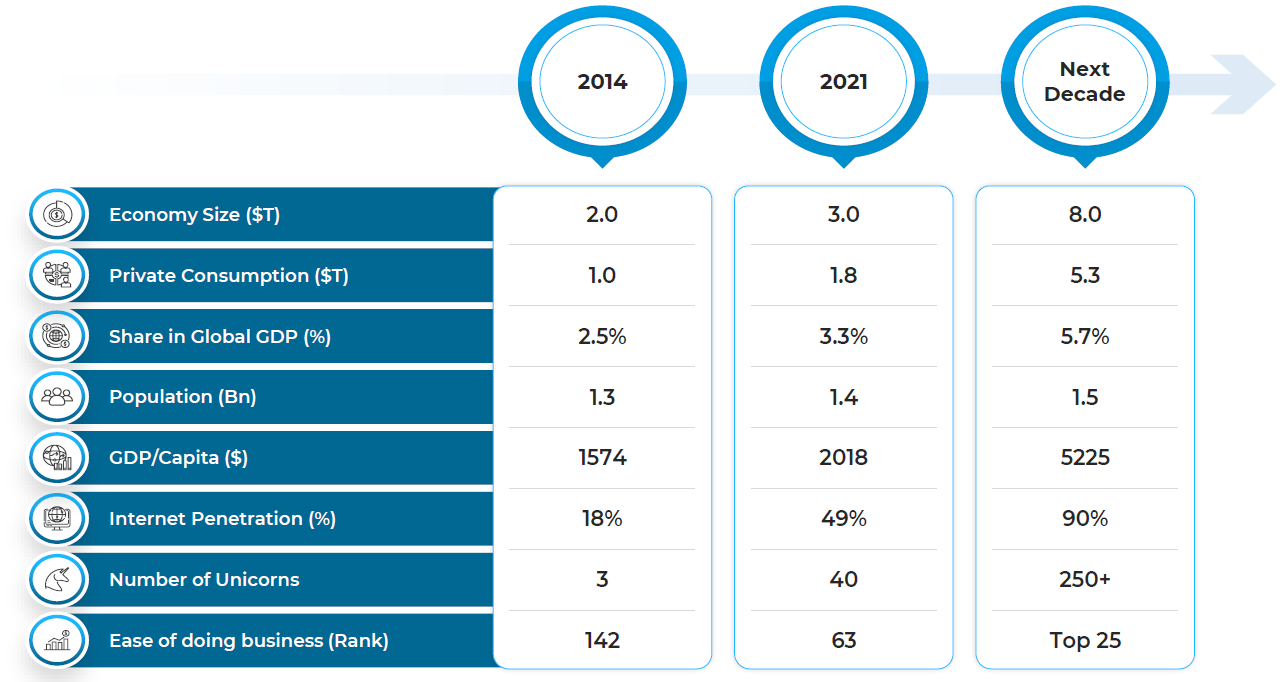

As one of the fastest growing economies in the world, India’s GDP is expected to more than double in the next decade. This will also lead to significant boost in the private consumption as it is expected to grow 3x in this period. Also, when per capita income crosses the $3,000 mark, it is considered as an inflexion point from a consumption perspective. And along with improvement in ease of doing business, increasing digitization and high interest penetration, we expect all this to provide a significant thrust to the startup ecosystem in the country over the next decade.

Indian startups have raised record funding of $220 Bn over the last decade (January 2014 to March 2024). In this period, we also saw over 100 companies achieve the Unicorn status, making us the 3rd largest country behind USA and China. A lot of credit for this has to go to the entrepreneurs who, through their innovation, creativity and execution, have been able to build some of the world’s most successful startups. An equally important role has been played by the Indian government which has promoted entrepreneurship and innovation through initiatives such as "Startup India", "Digital India", “Startup India Seed Funding”, “Pradhan Mantri Mudhra Yojna”, among others.

The Startup India campaign provides a range of benefits and incentives to startups, including tax exemptions, funding, and support for incubators and accelerators across the country to help startups get off the ground.

Another important factor contributing to the growth of startups in India is access to capital. Today, there are a growing number of angel investors, early-stage venture capital firms and family offices which are focused on providing capital and mentorship to entrepreneurs to help their ventures scale.

In addition to funding, there is also a growing pool of talent in India, with a large number of highly skilled engineers, developers, and entrepreneurs. Many of these individuals are returning to India after gaining experience and education abroad, bringing with them valuable skills and experience that can help drive the growth of startups in India. Government has also started emphasizing the importance of skill development to equip the youth with the necessary knowledge and expertise. India has been investing in skill development initiatives such as the Skill India Mission, which aims to train and upskill millions of young people across various sectors.

Finally, there is a supportive culture for entrepreneurship in India, with a growing number of people seeing entrepreneurship as a viable career path. This is reflected in the increasing number of startup events and conferences taking place across the country, as well as the growing number of co-working spaces and incubators.

At Rockstud Capital, we are glad to get this opportunity to be part of this ecosystem and contribute towards its growth. As a Fund, we invest in early-stage ventures that are domiciled in India. Through our second Fund, Rockstud Capital Investment Fund - II, we are looking to empower India's next generation of entrepreneurs. The Fund recognizes the immense potential of the country's youth and aims to create an ecosystem that nurtures their innovative ideas and transforms them into scalable businesses.

The Fund follows "YUVA Bharat" theme that emphasises on youth empowerment and engagement in building a strong and progressive India. It recognises the potential of the 21st generation and tries to harness their energy, ideas, and talent that is critical for building nation's future. It focuses on opportunities across sustainability, financial inclusion, health & safety and consumption. Some of the key building blocks under this theme include:

The Fund is a natural extension of our endeavour to offer the best one-stop alternative investments solution. As India moves towards becoming a $8 trillion economy over 2030, we feel this is an opportune time to double down investments in the startup space. Rockstud Capital will focus on partnering and identifying early-stage growth companies through a well-defined process and deep network to foster partnerships with founders building scalable businesses with a clear focus on profitability.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.