Date: 11 Sep, 2020

How team Rockstud coined this acronym as their winning strategy

Rockstud Capital LLP has been setup with purpose of advising and managing funds as Investment Manager to our SEBI registered Alternative Investment Fund Cat II “Rockstud Capital Investment Fund — Series I”. The scheme has hybrid investment structure to invest in early stage start-ups at Pre-series A and in Listed Equities traded on NSE (Exchange) in India.

When we started our fund journey upon receiving SEBI license in September 2018, our funds investment strategy was primarily towards sector agnostic side. During our fund deployment stage post initial closing in December 2018 under Listed Equities space, our benchmark Nifty Small Cap 100 Index had seen considerable correction i.e. -33% from its January 2018 peak. Our investments spanned across sectors like Technology, Textiles, Construction, Agri inputs, Financial Services, Rail EPC, Iron & Steel, Banks, etc.

However, post our initial deployment what we saw was unexpected by many as indices continued to slide where Nifty Small Cap 100 Index stoop to correction of -47% from January 2018 peak. Beyond market, global and macro factors as stories were unfolding, what we also realized was that certain companies under our portfolio were vulnerable by its own inherent fundamental weakness and were triggered negatively by market factors which led us to record negative returns on Listed Equities space to the tune of -22%.

During this phase, there were a lot of internal deliberations as to “what next” given the funds sub-optimal performance on Listed Equities side. First bold step we took was to clean up our wrong bets uncompromisingly. Post that, with our pro-active and nimble approach we renewed our investment focus towards a set theme in which we believed in unanimously which led to creation of “FACT-H” an acronym for Financials, Agriculture, Consumer, Technology and Healthcare.

We believe based on our collective experience, reading market and macro data, listening to various investment professionals and our internal sense suggested that we should not only have a clear mandate and framework of our stock universe but also go back to basics i.e. sticking to our circle of competence. No doubt being bold and open-ended sector agnostic proved too fatal for us and hence we zeroed down on certain themes that we believed had not only resilience towards markets volatility on downside but also had enough inherent strengths to ride ahead of index when in bull phase.

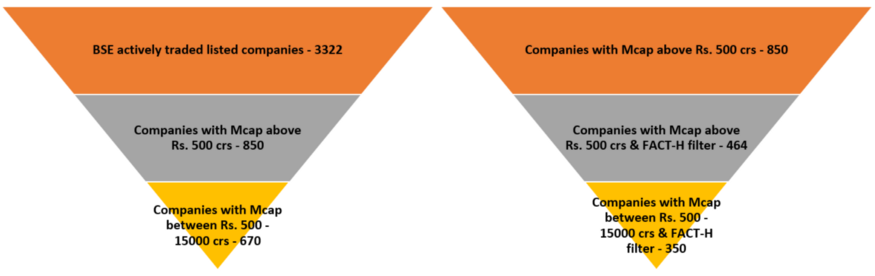

1. There are ~3300 companies listed on BSE which are actively traded (during November 2019). Out of which ~850 companies had a market capitalization of above Rs. 500 crs as of November 2019.

2. Our focus laid down primarily towards companies with market capitalisation in the range of Rs. 500–15000 crs for the fund and we were further narrowed down to 670 such companies.

3. Upon adding filter of our FACT-H these 670 companies were reduced to ~350 companies with 50 sub sectors. We strictly avoided companies from Alcohol, Tobacco and Pollution and PSU banking space for our final selection.

Hygiene check — Quantitative filters

We filtered our preliminary company selection based below parameters with renewed stock selection:

Step 1: — Real Free Float should be less than 50%

Real Free Float means Total shareholding % (minus) Promoter holding % (minus) Institutional holding%

Step 2: — Promoter Pledge near to 0

Pledge of promoter own holding should less than 10%.

Step 3: — ROE 3Y Trend

ROE for FY19 is more than 15%. Increasing trend of ROE is preferred; however not mandatory.

Step 4: — Free Cash Flow has to be positive for last 3 years

Debt/Equity and Interest Coverage ratio needs to be seen in line of FCF to get better picture of indebtedness and repayment capability. No fixed number. (Grey Area).

Step 5: — EBITDA margins more than 10% and PAT margin positive

EBITDA margins for FY19 is equal to or more than 10%. Difference between EBITDA margin and PAT margin should not more than 10% in case PAT margin is in single digit

Since the renewed strategy has been in place, our portfolio in said universe has gained +39% vs our benchmark Nifty Small Cap TRI Index of +0.12%. Looking at it from a near term hindsight perspective, our decision to recognize and bet on those themes such that on fund level seemed fruitful and we have reached break even in this recent rally with out-sized returns in few pockets.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.