Why we bought — Apart from financial parameters that we run across on quant below are some of the highlights which caught our attention for our investment.

· First, the percentage pie of global R&D spends on Auto to increase as cost of software in overall cost of car increases. The automotive industry is the largest contributor to the aggregate global R&D spend, accounting for nearly 16%, at ~$130 billion, and is expected to grow annually atleast 6%-7% over next 4–5 years. Top 5 global auto R&D spenders together contribute ~40% of this quantum. Further, roughly 10% of global R&D spends are outsourced due to IP protection related issues with OEM manufacturers so they resort to companies like Tata Elxsi Ltd to accelerate their technology and connect the gap. Further, time to market auto industry has reduced dramatically to less than 2 years vs 4 years in past. Key reason for faster times are urgent need to address market demand, supply chain efficiencies and technological advancement. Further, key attributes for shorter product development cycles include consolidation of vehicle platforms, convergence of automotive and consumer electronics, and expanded manufacturing capabilities.

· Secondly, we witnessed some of the key industry trends giving us some material sense of where the industry is leading going ahead. During 2015–2025, the top 10 global OEMs are expected to spend cumulatively ~$230 billion on autonomous and connected technologies. Asian OEMs are focusing on in-house R&D, while European and American OEMs are more focused on outsourcing R&D and collaborating through partnerships and acquisitions in this segment. EVs and HEVs are expected to account for ~30% of all vehicles globally by 2025 from ~1.3% in 2017, growing at a CAGR of ~27%. Historically, the pie of software embedded into auto has increased from 2% of total value of vehicle in 2000 to 18% of total value of vehicle. Going forward, it is expected to reach 23–25% over 2019–2024. Tata Elxsi announced one of the top 5 automotive OEM to have licensed its advanced autonomous vehicle “middleware” program — AUTONOMAI for their driverless car R&D.

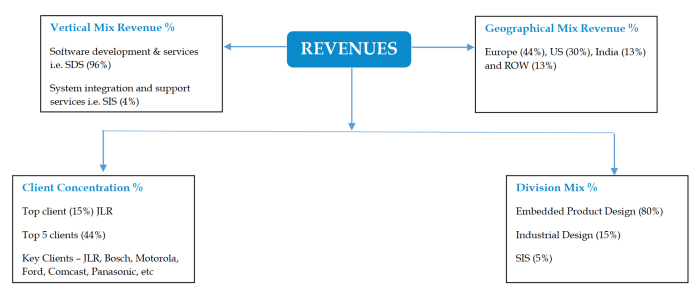

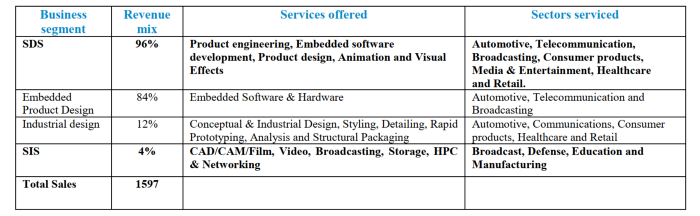

· Thirdly, best in class margins, returns profile and changing business mix. It has historically out beaten industry growth by NASSCOM by 150–200 bps to ~14–15% and has met their own guidance (for FY20, they expect top line to grow ~15% and maintain margins). Given its focus on EPD ~ 80% of sales vs average peers stands at 65–70%, co. has able to clock superior margins historically. Co also has one of the lowest attrition rate at 12% vs industry average of 15- 17%. Co is focusing on de-risking its business industry from Auto being major currently at ~50% to 40% over next 2/3 years by expanding in verticals like FMCG, Retail & Healthcare. To spur growth under said segment they would be looking at inorganic expansion as they have comfortable cash position at ~45% of total assets.

· With above investment arguments, continuous increase in automation and software led innovations, global EPD R&D spend trajectory shows Tata Elxsi’s focus remains in sunrise industry where very few players have attained the niche. We still hold the stock in our portfolio at this point.