Date: 25 Aug, 2023

Total No of Deals Funded – 71

Total Investment across the Deals- INR 3,248 Cr ($ 406.3 million)

Funding Pattern from January 2023 till July 2023

Amount in USD Mn Top Investments of July 2023

Other notable deals this month included Genleap’s $50 million funding round and KaarTech’s deal of $53 million round in Course5Intelligence, $50 million in SafeSecurity and $45 million in Capillary Technologies.

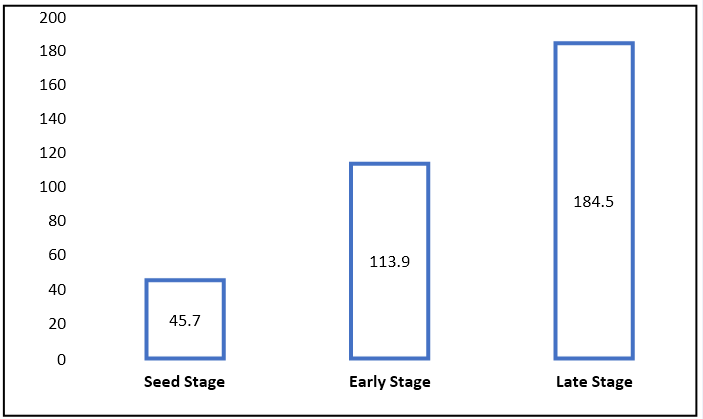

Stage-wise Deal Analysis

Amount in USD MN

The investor preferred to bet on the late stage deals with already having a good traction, rather than investing in seed stage deals. Here Seed Stage is defined for Pre-Revenue, Seed and Angel round deals, Early Stage is defined as Pre-Series A, Series A & Series B startups and Late Stage is defined as Series B and above deals

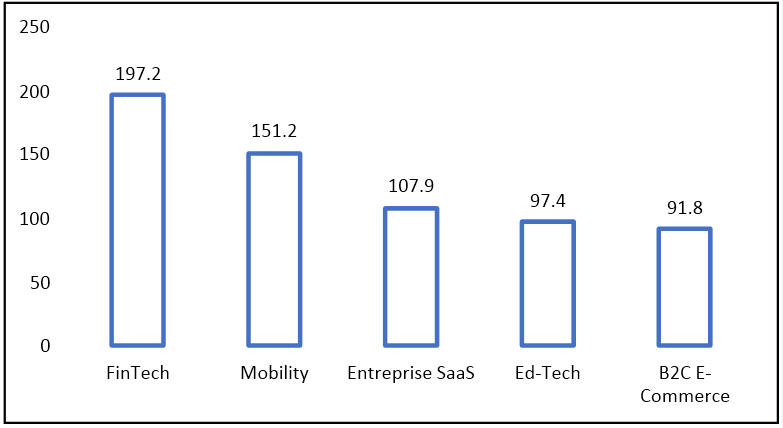

Top 5 Sector-wise Analysis

Amount in USD MN

Source: Tracxn

Source: Tracxn

Fintech emerged as the most favourites sector for the investors including Lending Tech and Insur-Tech, followed by Mobility.

City-wise Analysis

In July, the highest investment was done from Delhi NCR region participating in 24 deals, followed by Bangalore with 22 deals and Mumbai with 8 deals. Other cities include Surat, Pune, Chennai, Ahmedabad, Bhubaneswar and others participated in total of 17 deals.

Regulatory Updates

Angel Tax on Non-Resident Investments

Introduction of the Corporate Debt Market Development Fund

Issue of units in dematerialized form

For More Details Read Here.

Rockstud Thoughts:

While the Indian startup ecosystem has progressed significantly over the last decade, there are still issues that must be addressed. One of the most significant difficulties for entrepreneurs in India is a dearth of early-stage investment, which makes it difficult for firms to get off the ground. While overall the funding environment continues to witness slowdown, some of the active VC Funds in India have raised new capital in the past year and we can expect the pace of investments to pick up over the next couple of quarters. In the interim, we continue to see increased focus on due diligence prior to investments to ensure that the start-ups have a robust corporate governance framework. There is also a scarcity of experienced mentors and advisors, which can make navigating the complex world of entrepreneurship challenging for companies. Despite the obstacles, India's startup ecosystem is primed for further expansion and success in the future years. India is well-positioned to become one of the world's leading startup hotspots, with a supportive government, a rising pool of talent, and a culture that celebrates entrepreneurship.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.