Date: 03 Jul, 2023

At Rockstud we believe India is at cusp of transformation derived through country's rich history, diverse culture, and rapidly growing economy, it has laid the foundation for a decade that promises to be pivotal in shaping India's future. With its youthful population and government initiatives India is poised to make great strides.

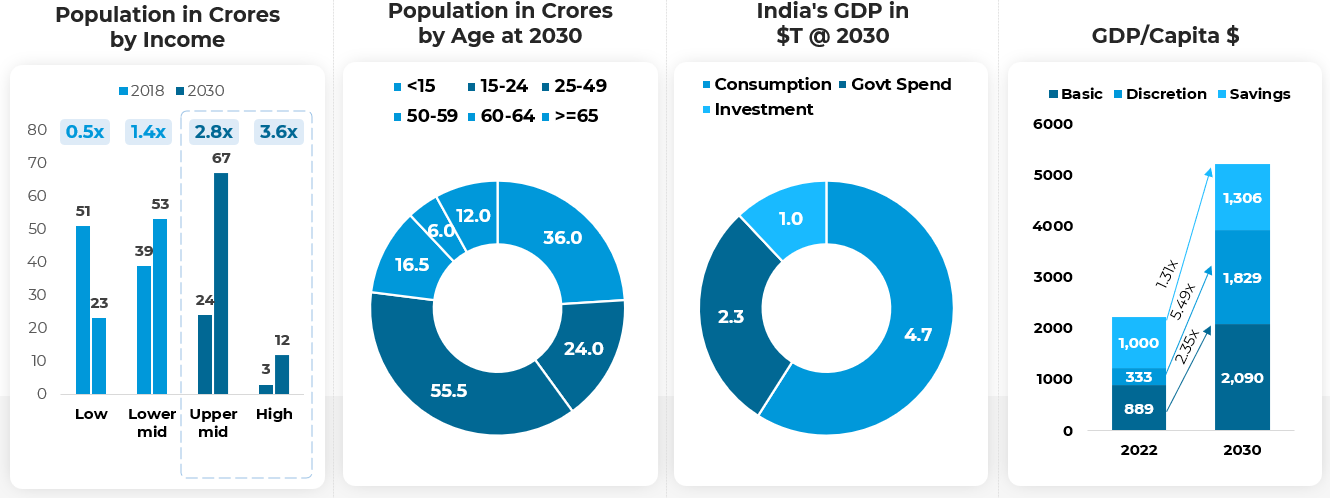

We believe India’s Nominal GDP is set to increase from ~$3.5T to ~$8T by 2030 led by twin engine of growth rising middle class income and increased discretionary spending aided by digital prowess and backed by policy initiatives of government. Government rolling out reforms with emphasis on Digital India, Atmanirbhar Bharat, Startup India etc has created a conducive environment resulting in India being fastest growing economy in the world.

With 1.3bn people carrying Aadhaar ID, doing financial transactions has become easy and cheap. UPI has scaled well beyond expectations and now processes 4.5bn payments per month. Cumulative direct benefit transfers of over $300B to Aadhaar-linked bank accounts (Jan Dhan) has been success. Lastly, Fastag highway toll system which collects about Rs. 130 crs/day and is allowing the government to recycle road assets.

One of the key areas where India is expected to witness remarkable progress is in technology and innovation. With the advent of disruptive technologies like artificial intelligence, blockchain, and the Internet of Things, India has the potential to become a global technology powerhouse. Initiatives like "Digital India" have already set the stage for the widespread adoption of digital technologies, and the coming decade will see a surge in tech startups and innovative solutions across various industries

With the right strategies and investments, key sectors like IT, Healthcare, Financials, Real estate, Auto & Auto ancillary to name few can become major drivers of India's progress, generating employment, attracting investments, and fostering innovation.

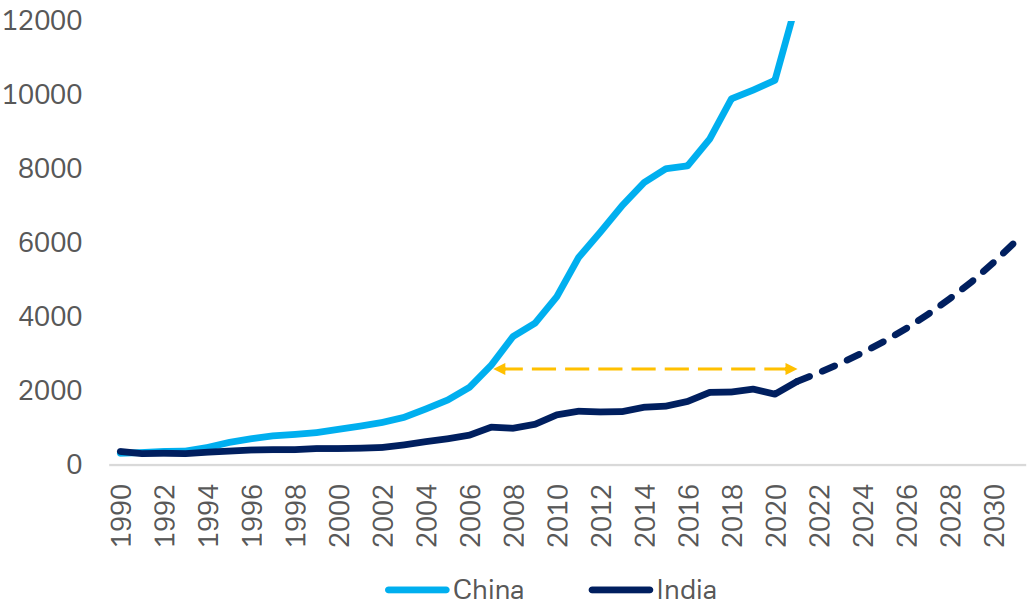

As per, Per capita GDP ($) forecast for India, it is today at where China was in 2006-07

- 1 - Refinitiv, DataStream, Deutsche Bank AG

- 1 - Refinitiv, DataStream, Deutsche Bank AG

India has now overtaken China to become the most populous country in the world and is forecast to add 97M people to its working population over the next 10 years. With the current median age at 28.4 years and rising to just 31.7 by 2030, the demographic advantages of a young populations are ready to be utilized.

- 2 - World Economic Forum, CBRE Research, RC Research, UN Dept of Economic Affairs

Over the next decade, India will enjoy the largest workforce growth of any single country in the world, and account for 22% of global workforce growth.

As affluence continues to rise, India becomes home to the largest middle class in the world, now estimated at 371M, which will continue to provide purchasing power from within. The combination of a young population and a huge middle class bodes well for consumption over many decades to come.

Electricity, cooking gas and clean water has released many free hours in a day from the previous need to fetch firewood and water. Rather than simply providing welfare gains, the unoccupied time has been converted into commercial enterprise, with self-employed activities such as handicrafts and

poultry farming increasing economic wellbeing of households.

Some of the noteworthy growth metrics India is expected to outshine over decade:

IT sector

Consumption

Healthcare

Finance

In conclusion, India's decade 2030 holds immense promise and potential. It is primed to emerge as fastest growing economy in this decade thus overtaking Germany & Japan to be 3rd largest economy by GDP. At Rockstud we are focused on riding this growth with clear focus on select sectors that are expected gain from inclusive growth, prosperity, and a brighter future for its citizens and the world at large.

Source: Morgan Stanley:The New India, Report, IBEF, McKinsey, Boston Consulting Group:India Economic Monitor.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.