Date: 30 Oct, 2021

Persistent Systems Ltd (PSL) was our bet on factors like globally, there’s a surge in demand by traditional businesses to digitize its legacy business to not only thrive in short term but in order for businesses to remain relevant in the long term with digital transformation plans. These plans will potentially bring forward planned upgrades, improving digital infrastructure and build AI (Artificial Intelligence) and ML (Machine Learning) embedded in their systems to better cater to ever-dynamic customer needs. This was picked by our fund Rockstud Capital Investment Fund Series I around Rs. 750–800s and we are currently riding it by ~4x in 1 years’ time.

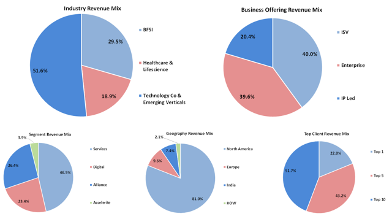

Company Brief — PSL, a midcap software company enables those in the “business of software” and those “building software-driven businesses” via technologies like AI, Machine Learning, Data and Cloud Services, Identity, Access and Security and Internet of Things for industries like Banking, Financial Services, Insurance, Healthcare, Life sciences, Industrial Manufacturing etc. It is one of the few companies to have an innovative business partner ecosystem of roughly 30 such partners with major partners being Salesforce, AWS, Microsoft, IBM, Google Cloud Platform, Oracle, etc.

In 2017, they reorganized their business verticals as Services, Digital, Alliance and Accelerite.

Under Services, they focus on software design and product development to ISVs for developing next generation of technologies;

Under Digital, they focus on “How of” digital by bringing together their technology partner ecosystem, solutions and distinct architecture to enable enterprises to go digital;

Under Alliance, they provide services related to IBM products (Watson+IOT) and software development work for IBM

Whereas under Accelerite they develop infrastructure software for enterprises, telecom operators and public sectors through IP led business (acquired software’s like ShareInsights and NEURO) and inbuilt platforms.

Why we bought — Apart from financial parameters that we run across on quant below are some of the highlights which caught our attention for our investment.

· First, prior to a shakeup in the global ecosystem led by the Covid-19 outbreak, the term digital would merely feel aspirational when it came to transforming businesses. But things changed rapidly when moving to digital became a requirement to keep pace with demands for businesses.

Some interesting data points on macro-level worth pondering on: McKinsey estimates AI can deliver global economic activity of around $13 trillion by 2030. In India specifically, Phoenix Research predicts that the AI market will grow significantly through 2025, with increased adoption of cloud-based services and the growing demand for intelligent virtual assistants. By 2023, the worldwide number of IoT-connected devices is expected to increase to $43 billion. PSL had recognized this trend ahead of its peers and was nimble enough to make significant efforts towards building its team and expertise to cater to surge in demand. To highlight, their revenues from the digital vertical grew from 16.3% (FY17) to 42% (Q1FY21). PSL is seeing strong traction and winning projects, where customers are looking at custom-built development on newer technology and focus on IP led offerings, digital transformation, software-based offerings and large enterprise accounts for future growth.

· Secondly, Industry areas where PSL has zeroed its focus are Healthcare, BFSI, Software Product companies, Life sciences, etc. where accelerated growth is expected going ahead in the areas of SMAC (social media, mobile, analytics and cloud). According to IDC estimates global spending on information and communication technology is expected to touch $6trn by 2023 from $2.3trn (2018) where SMAC will continue to drive double digit-growth. Healthcare and Life sciences digital transformation would help entities with electronic records, artificial intelligence devices to improve patient care, improve efficiency, minimize errors and thereby improve productivity.

This industry is expected to show a FY18–25E CAGR of 23% to $210 billion. BFSI vertical which is another important vertical for PSL is one of the fastest growing with robust growth across all geographies. The factors that are driving the growth further are the increasing adoption of smartphones and smart devices, growing digital payments, the introduction of digital currencies and the use of big data tools to analyze a large amount of financial data. This industry is expected to show a FY18–25E CAGR of 25% to $121 billion.

· Thirdly, PSL wants to grow both organically and inorganically to cater its future growth. Inorganic growth will be supported by acquisitions in three key areas which can assist the company in — 1) Expanding its footprint outside of North America like Parx, 2) IPs which can increase its capabilities and strengthens in newer technologies like machine learning, blockchain, chatbot, etc. and 3) Strengthen its domain capability. The rationale behind acquisition is to sell next-generation products to customers who want to elevate to software-driven business. As of June 2021, the co. has cash and equivalents of Rs. 200 crs to support acquisitions.

· With the above investment arguments and co.’s focus on large annuity deals, accelerating services reach in Europe, deepening digital technologies and increasing deal size will remain key growth drivers for the future. We still hold the stock in our portfolio at this point.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.