Date: 09 Sep, 2023

Nifty continues its winning streak: After a streak of consecutive higher closing, Nifty ended at 19253 down 500 points (-2.5% MoM) for the month of August 23. Nifty index till date is up 6.3% for CYTD23 and 10.9% for FYTD23. While broader markets continued to outperform benchmark indices i,e, Nifty Midcap 100 /Nifty Smallcap 100 indices up 3.7%/4.6% while outperforming benchmark index by 6.2%/7.2% for the month of Aug’23. Similarly, in CY23YTD, midcaps/smallcaps indices have outperformed largecaps and both have risen ~25% vs. a 6.3% rise for the Nifty.

Last month saw some of the sector trends to continue i.e. FMCG, Energy, Finance continued to underperform.

Source: B&K Securites

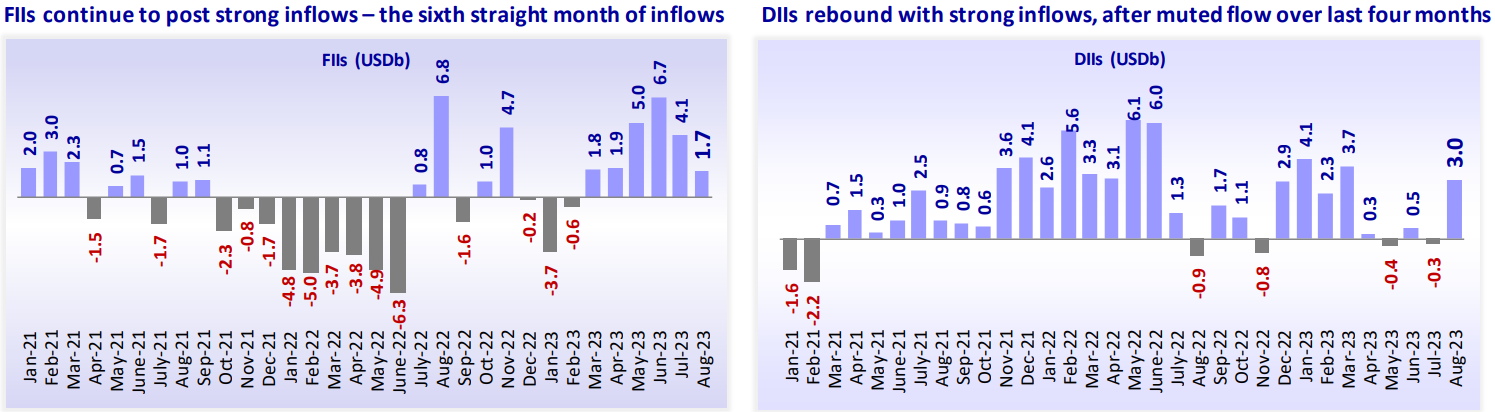

Flows: FIIs remained net buyers for the straight sixth month at $1.7B in Aug’23, while buying intensity has slowed down compared to last 5 months; CYTD inflows stood at $16.9B propelling Index levels to remain at its peak 19253. DIIs turned net buyers in Aug’23 at $3.0B, with CYTD inflows at $10.8B.

Source: MOSL

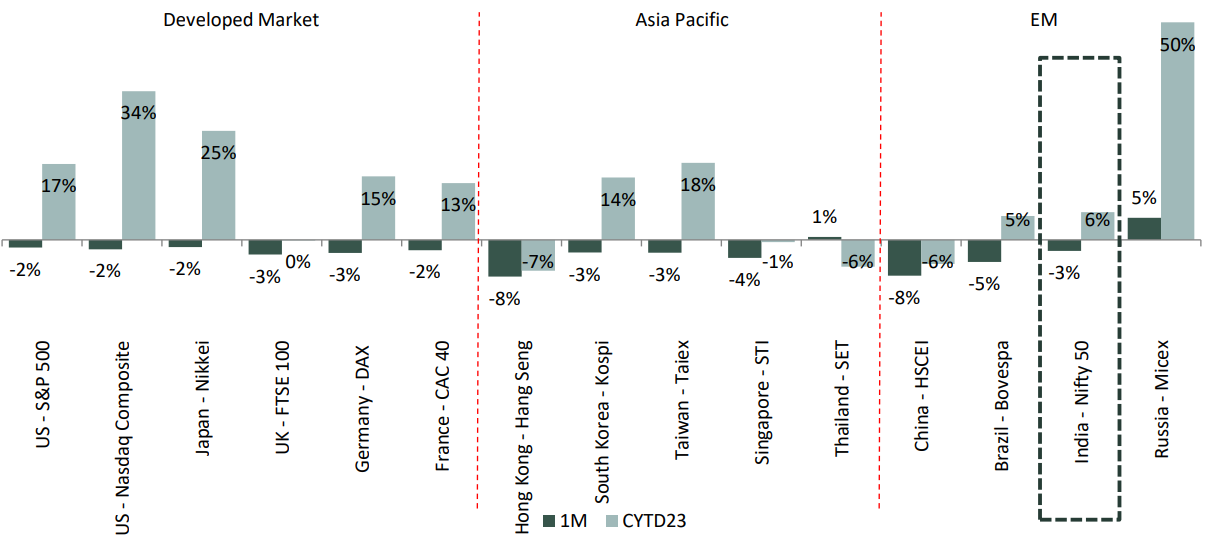

Global: Globally equity indices were weak on profit booking in Aug-23, with S&P-500 and Nasdaq down 2% MoM. Over last 6 months, despite recession worries, S&P and Nasdaq is up 17% and 34% in CY23E so far. Hang Seng index fell 8% while Russian Micex was up 5% in Aug-23. In Jul’23, BoE, Fed, and ECB hiked rates by 25bps each. RBA decided to hold rates unchanged in Aug’23 as well. All major central banks are due to announce their decisions in Sep’23. Fed Chair Jerome Powell’s Jackson Hole speech indicated that the Fed would likely remain data dependent in deciding its interest rate trajectory. In case of BoE and ECB, uncertainties persists. In Eurozone, inflation has begun to inch up again in Aug’23 and in UK prices still remain elevated and risks from wage increase persists.

Source: IDBI Capital

Corporate earnings 1QFY24: Corporate earnings for 1QFY24 came in strong and could underpin the underlying overall optimistic narrative of India. After a solid 23% earnings CAGR over FY20-23, Nifty posted 32% earnings growth in 1QFY24, a beat resulting in upward revision of 3 to 5% in earning expectations for FY 24 & FY25 at Rs 965/1150 respectively. Once again, the earnings growth was propelled by domestic cyclicals, such as BFSI and Auto while Metals dragged the aggregate profitability. The banking sector posted a mixed 1QFY24, driven by healthy loan growth and sustained improvement in asset quality; however, margin trajectory reversed due to a sharp rise in funding costs

Monsoon Update: The overall rainfall deficit until 3rd Sep stood at 11% below normal, with all the regions receiving below-normal rainfall, barring northwestern India (normal). Central India (12% below normal), South Peninsula (14% below normal) and the eastern and northeastern regions (18% below normal) have witnessed deficient rainfall. Kharif sowing as of 1st Sep’23 stood at 0.4% higher than last year.

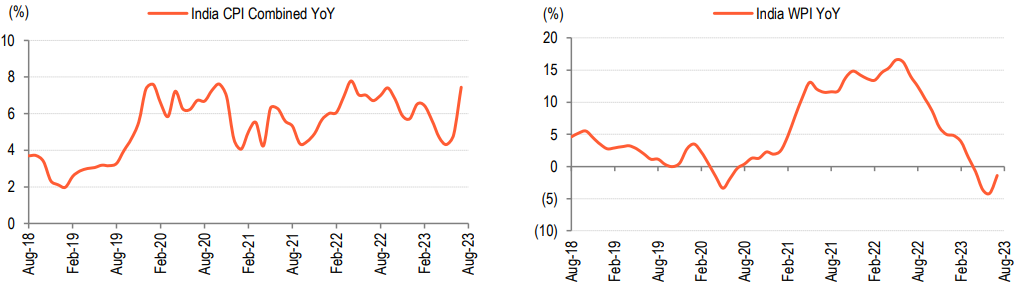

Inflation : CPI inflation rose way more than our expectation of 5.8% to 7.44% in Jul’23 from 4.8% in May’23, on YoY basis. The upside surprise was on account of 702bps jump in food inflation, led by 37.3% jump in vegetable inflation from 0.9% decline in Jun’23, on YoY basis. Headline WPI fell less than expected in Jul’23. It was down by (-) 1.4% versus estimate of (-) 1.7% and (-) 4.1% in Jun’23.

Source: BOBCaps

Source: BOBCaps

Currency: After depreciating to a record-low during the month, INR made a smart recovery to end the month only marginally lower. Pressure on the currency has come from worsening global backdrop of a strengthening dollar and elevated oil prices. RBI intervention helped the currency pair to limit losses. Elevated oil prices and a moderation in FPI inflows are likely to weigh on INR in the near-term. Fed rate trajectory will be contingent on incoming data and the US jobs report due later in the day will shed more light on the same.

Yield: RBI continued to maintain Repo rate at 6.5% in its last policy meet. Liquidity seems comfortable with RBI absorbing ~Rs.1.6tn over last five trading days. The Indian bond yield closed at 7.2% vs. the US bond yield of 4.1% in Aug’23. The yield spread has been at its lowest in Aug’23 vs. its previous low in Feb’09. Fed Chair Jerome Powell’s Jackson Hole speech indicated that the Fed would likely remain data dependent in deciding its interest rate trajectory. Note, US 10-year yield, up 14 bp during August, remains elevated at 4.114%.

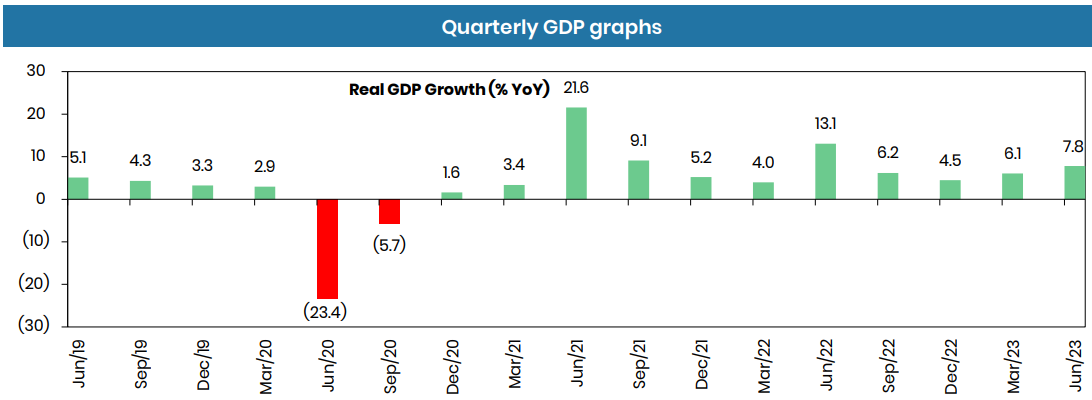

GDP: India’s Q1FY24 GDP growth was at 7.8% a continued domestic growth momentum despite global challenges in line with consensus estimates. Private final consumption expenditure contributed ~35% to quarterly GDP growth while investments contributed ~45%, net exports contributed ~58% to GDP during the quarter. With overall rainfall deficiency remains at -11% as of 3rd September and continues effects of El-Nino persists, rainfall in September remains to stay impacted which will keep inflation a tad higher than estimated. Growth is likely to be decent from Q3 onwards led by festive season.

Source: B&K

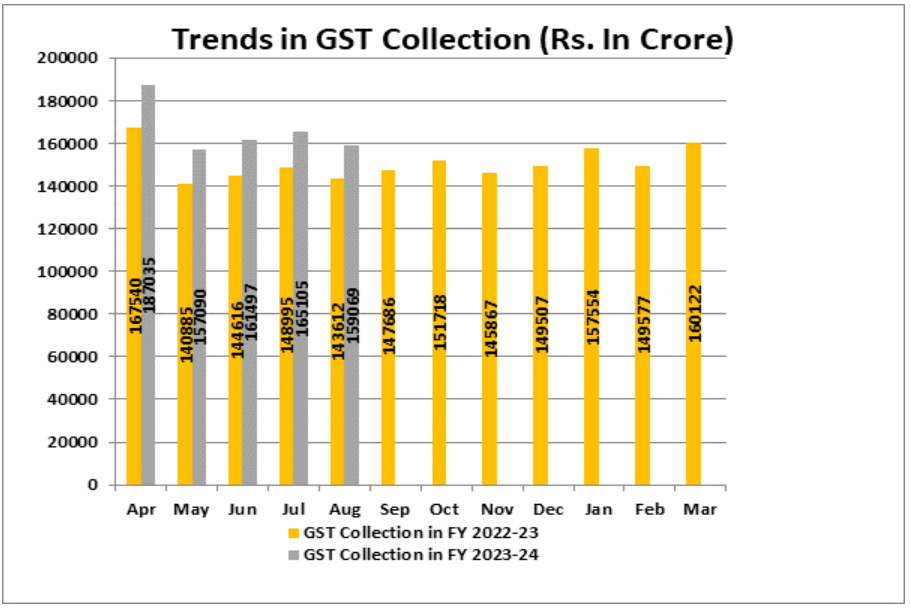

GST: The gross GST revenue collected in the month of August, 2023 is Rs.1,59,069 crs. The revenues for the month of August, 2023 are 11% higher than the GST revenues in the same month last year. During the month, revenue from import of goods was 3% higher and the revenues from domestic transactions (including import of services) are 14% higher than the revenues from these sources during the same month last year.

Source: PIB

Portfolio Manager Commentary:

Fund manager’s Commentary - Equity market consolidated in narrow range while ending its 4 months winning streak in the month of August, while macro data (GST, E-way bills, PMI etc) continues to show optimism surrounding the Indian economy. We believe improving economic fundamentals along with superior demographic profile and improving per capita income would drive India to become third largest economy by 2028. Through our YUVA Bharat PMS strategy, we endeavour to participate in India growth story.

Equity markets after remaining range-bound over the past 20 months, has finally broke out of range and surpassed the previous highs in Jul’23. While markets optically are at all-time high, in terms of earnings during the same period from FY21 to FY23 nifty earning has expanded from Rs. 542 to Rs. 807 a CAGR of 22% over the same period, thus on relative basis valuation are relatively reasonable compared to Oct 21 peak. Nifty currently is trading at 23.8x, while on quarterly rolling forwards basis at 18.3x it is near its 10-year average. Looking at overall flows, momentum in economic activity (PMI, GST, GDP) along with 1QFY24 earnings beating market elevated expectations has resulted in earnings upgrade of ~ 3-5% 965/1150 for FY24 & FY25 respectively. However, we keep cognisance of global concern on inflation and rates, Ongoing conflict between Ukraine and Russia and Monsoon spread and Agriculture sowing data. We believe Time in market is more important than timing the market from long term wealth creation.

Source: MOSL

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.