Date: 12 Oct, 2023

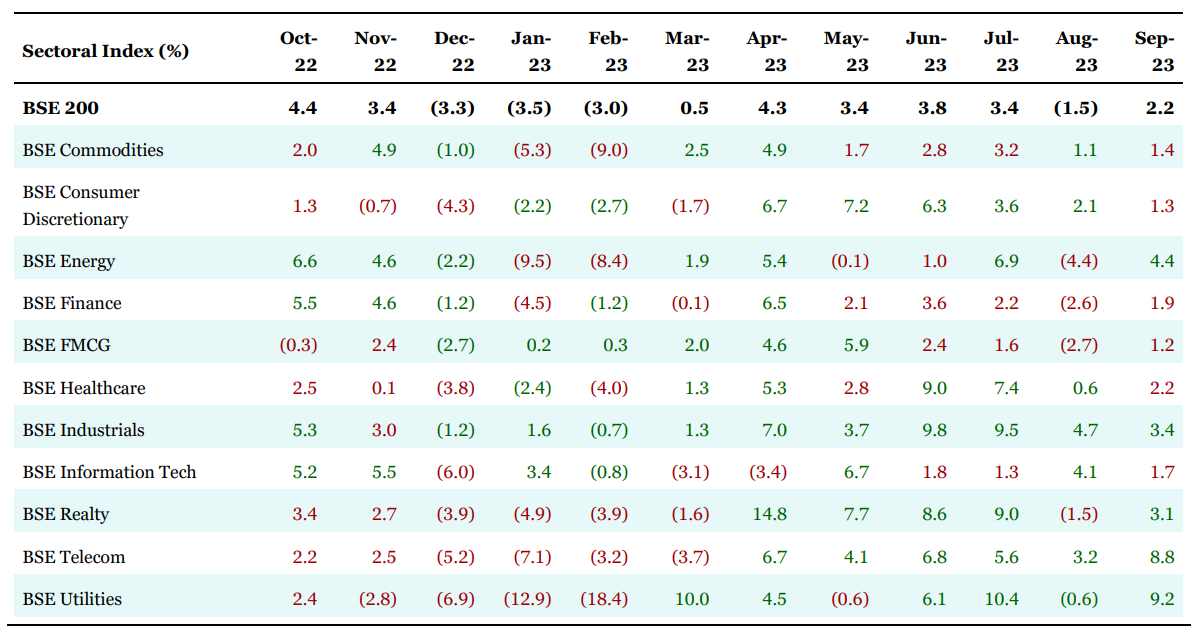

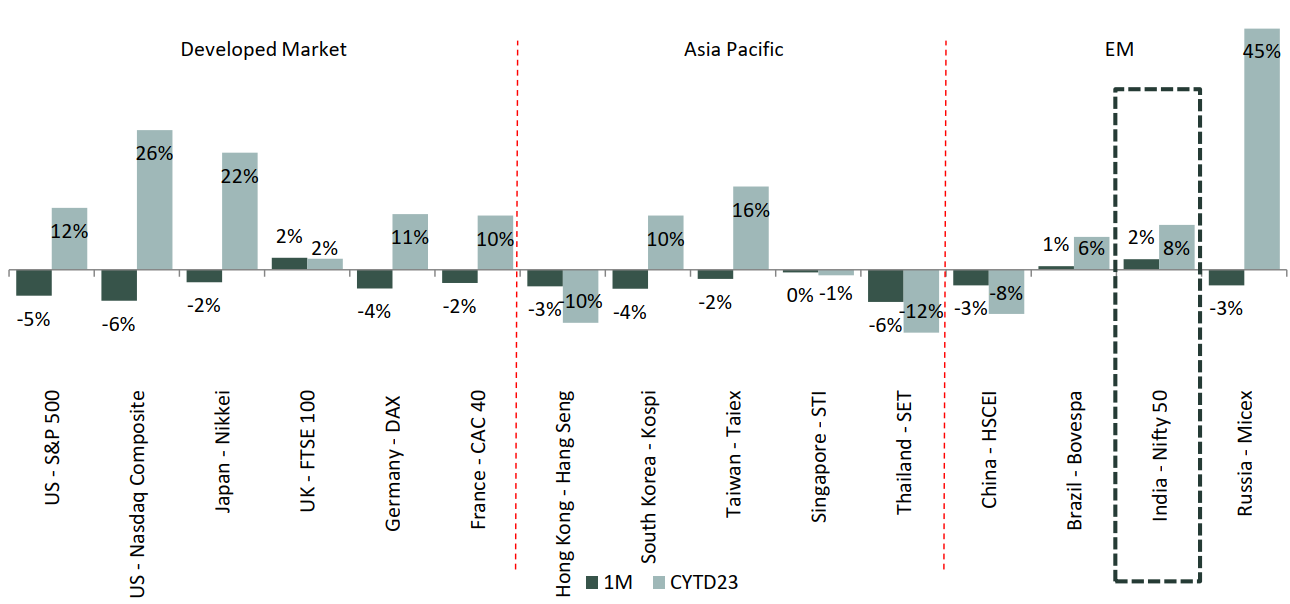

Nifty continues its winning streak: Indian equity market (Nifty-50) was a clear outperformer in Sep-23 as it recorded gain of 2% MoM while most of the global indices were lower. Small and mid-cap indices outperformed Nifty-50 (sixth month in a row) with gains of 4% each. Nifty index till date is up 8.5% for CYTD23 and 13.1% for FYTD23. Mid cap index trades at upper range of its historical valuation PE band. Mid Cap PER valuation premium (Nifty Mid Cap 100) to Nifty-50 has expanded to over 35% (versus historical avg. of 10-15%).

Source: B&K Securites

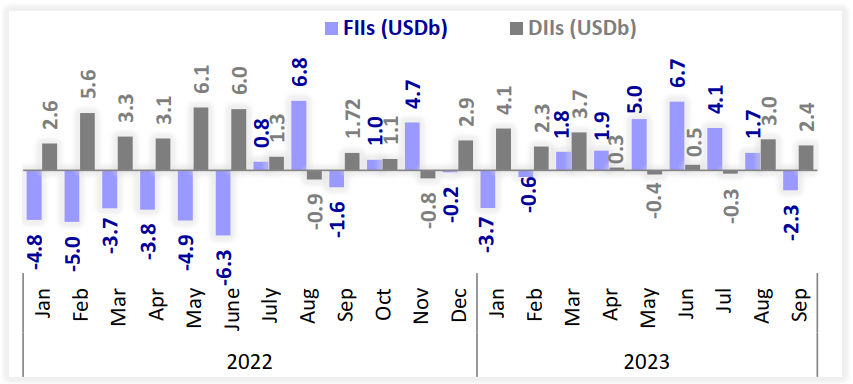

Flows: FIIs turned negative for the first time after remaining positive for straight six months at - $2.3B. CYTD inflows stood at $14.6B propelling Index levels to touch new peak at 20222. DIIs remained net buyers in Sep’23 at $2.4B, with CYTD inflows at $15.6B as SIP monthly flows continued to remain strong at Rs. 16000 crs vs Rs. 13000 crs on yoy basis.

Source: MOSL

Source: MOSL

Global: Barring the FTSE100, most major global indices were under pressure in September. US indices were down 4-5% and both the Hang Seng and Shenzhen continued their declines from August. However, the FTSE100 clocked much better returns during the month at 2.3%. Global growth remains unpredictable with US economy not slowing as much as anticipated, China showing signs of recovery and Eurozone and UK economies faltering more than expected. In the US, lower jobless claims, pick up retail sales and industrial output, improvement in employment sub-index for ISM manufacturing PMI and higher than expected job openings indicate that economy remains on solid ground so far. On the other hand, slowdown in demand from China, has hampered manufacturing activity in Eurozone and UK. However, now with China showing signs of improvement, global demand may also pickup, leading European economies out of their slumber. In Sep’23, US Fed and BoE held rates unchanged, while ECB hiked its main policy rate by 25bps to 4%. On the other hand, in Asia, PBOC continues to loosen its monetary policy to support growth, and BoJ is hinting that discussions might be underway to formulate a gradual exit from its ultra-loose policy.

Source: IDBI Capital

2QFY24 Corporate earnings preview: 2QFY24 earnings will be key event to watch in the October. Having said that, consensus has upgraded Nifty-50 EPS by 2-3% for FY24E/25E post Q1FY24 result season. While Nifty earnings are likely to grow 21% YoY in 2QFY24, it is anticipated to be driven once again by domestic Cyclicals, such as BFSI and Auto, while Technology and Metals are anticipated to report moderate earnings growth.

Monsoon Update: Monsoon showed strong recovery in the month of September’23 after poor spell in August, resulting cumulative rainfall at 6% below long-term average (until September 29th). On cumulative basis, there are some concerns over spatial distribution as rainfall was normal in north-west, central India and south India while it was relatively weaker in east and north-east India. Overall basins and reservoirs levels were 7.7% below long-term average until September 29. In terms of cropping activity, overall kharif sowing, as of 22 Sep 2023, has been only by 0.3% higher compared with last year.

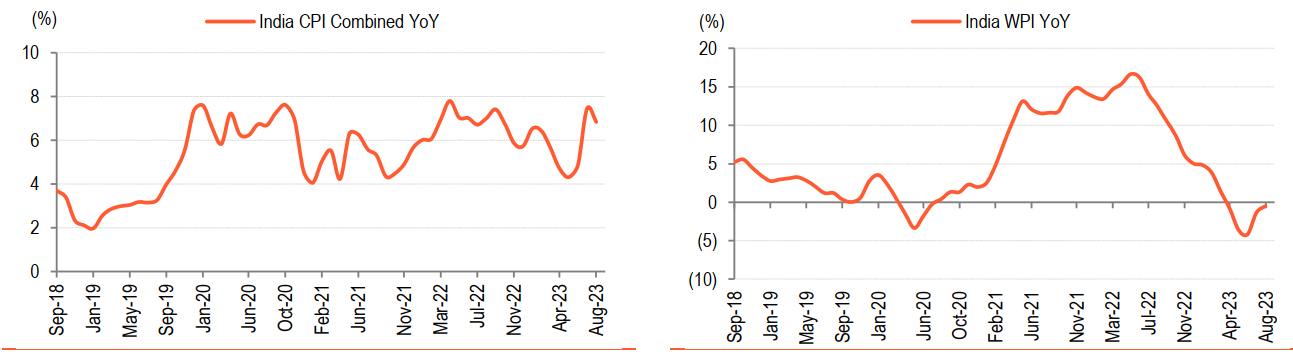

Inflation: Latest CPI print for Aug’23 shows that inflation came down to 6.8% from 7.4% in Jul’23. RBI has estimated 6.2% CPI for Q2, and to meet that target, inflation for Sep’23 needs to come in at ~4.3-4.5%. The likely comfort came in from 157bps drop in food inflation which moderated to 9.9% from 11.5% in Jul’23.

Source: BOBCaps

Currency: INR depreciated to a fresh record-low of 83.18/$ on 15 Sep 2023 led by a confluence of adverse shocks of rising dollar, higher oil prices and FPI outflows. In Sep’23, INR is lower by 0.5%. Pressure was also seen on other global currencies as DXY rose by 1.6%. INR has been caught in the perfect storm of rising oil prices and higher US dollar. Oil prices have sustained above $ 90/bbl in Sep’23, compared with $ 85/bbl on average in Aug’23. Oil supply is expected to remain tight led by output cuts from Saudi Arabia and Russia. On the other hand, demand is expected to be high due to seasonal factors as well as early signs of recovery in China. Market participants expect oil prices to inch up to ~$ 100/bbl in the coming days, a level last seen in Aug’22. Apart from this, INR has also been impacted by a moderation in FPI inflows.

Yield: MPC committee unanimously decided to keep Repo rate unchanged at 6.5% They further maintained growth forecast for FY24 at 6.5%. The governor has reiterated his commitment to bring inflation down to 4% on durable basis. Near term inflation is expected to soften on the back of vegetable price correction especially in tomatoes and reduction in LPG prices however demand supply mismatches in spices are likely to keep prices at elevated levels.

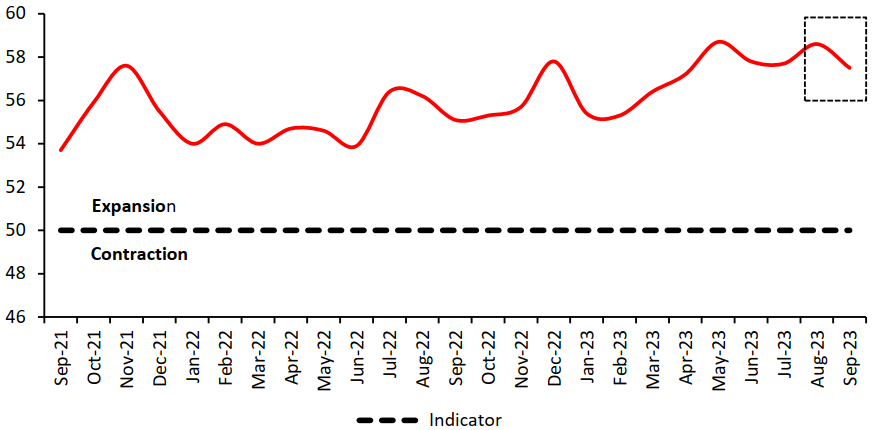

PMI: India’s manufacturing PMI data showed a slight slowdown in the index from 58.6 in August to 57.5 in September. India’s manufacturing sector is witnessing expansion since the last two years. This was largely attributed to significant increases in new orders and output, reflecting resilience in demand, even though the input costs have started to show some slowdown in September after rising to a one year high. The slowdown in inflation has will act as a breather for the manufacturers, but other factors like geopolitical issues, rise in crude prices and El-Nino could have negative impact on the manufacturing sector.

Source: CMIE

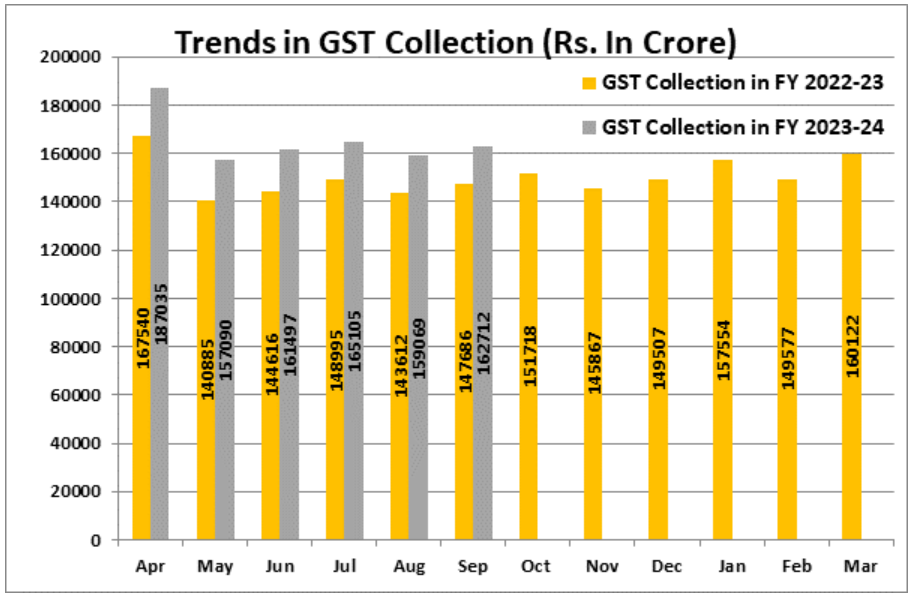

GST: Growth in India’s gross Goods and Services Tax (GST) revenues slowed to a 27-month low of 10.2% in September, from around 10.8% in the previous two months. However, collections improved 2.3% over August revenues to touch Rs. 1,62,712 crs. The gross GST collection for the first half of the FY 2023-24 ending September, 2023 is 11% higher than first half of FY 2022-23. The average monthly gross collection in FY 2023-24 is ?1.65 lakh crs a 11% higher than average monthly gross collection for first half of FY 2022-23.

Source: PIB

Fund Manager Commentary:

Fund manager’s Message – After a momentary pause in month of August, equity market renewed its upward momentum in month of September. With onset of October we are ushering into festive season while macro indicators like (GST, E-way bills, PMI etc) are indicating preparedness ahead of festive season consumer spending velocity would demonstrate optimism surrounding the Indian economy. Inclusion of Indian government bonds in JP Morgan emerging market bond index with 10% weight from June 24 to March 25 would lead to ~$30 to $40 bln flows into India. We believe inclusion of India in Global bond index indicates improving economic fundamentals along with superior demographic profile would propel overall economic growth Through our YUVA Bharat PMS strategy, we endeavour to participate in India growth story.

Equity markets after remaining range-bound over the past 20 months, has finally broke out of range and surpassed the previous highs in Jul’23. While markets optically are at all-time high, in terms of earnings during the same period from FY21 to FY23 nifty earning has expanded from Rs. 542 to Rs. 807 a CAGR of 22% over the same period, thus on relative basis valuation are relatively reasonable compared to Oct 21 peak. Nifty currently is trading at 24.3x, while on quarterly rolling forwards basis at 18.6x it is near its 10-year average. While we are entering into 2QFY24 earning season with expectations of 21% earnings growth for Nifty 50 it also coincides with start of festive season management commentary around demand and consumer sentiment would be closely look forward to. For FY24 & FY25 markets estimates Nifty earnings to be Rs 986 /Rs 1132 respectively thus building in 22%/15% earnings growth. However, we keep cognisance of global concern around higher interest rate and geo political conflicts. We believe “Time in Market” is more important than timing the market from long term wealth creation.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.