Date: 08 Oct, 2022

Global scenario

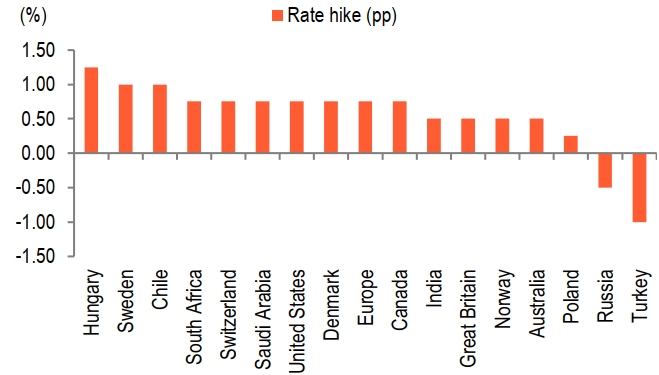

Going into September, markets throughout the world were dominated by a weakening outlook and a series of rate rises ranging from 0.25% to 1.25%. These rates are now higher than they were previously. According to the World Economic Forum's chief economist outlook poll, we are on the brink of a recession and an uncertain future in 2023, which is weighing on fluctuating commodities prices.

So far, the Fed has hiked rates by 300 basis points, squeezing liquidity and lowering the values of numerous leading US equities. We expect that these rates will stay high until inflation subsides.

Figure 1 - Bloomberg, BOB Cap Research

In the United States, inflation was 8.3% in August, compared to an expected 8.1%, while the pound fell when the new administration presented its economic plan, which included the greatest tax cuts in 50 years at a time when inflation was close to 10%. To calm markets, the Bank of England intervened with temporary quantitative easing that will endure until October 14th.

The Fed has made it quite obvious that its policies of tightening monetary conditions are going to cause economic hardship and slow development in the United States. The IMF, too, has forecast sluggish global growth in CY22 and CY23. Europe remains in a bigger mess with higher energy costs, weakening consumer confidence and tightening monetary policy which can structurally impact the Block.

Commodities have fallen due to recession worries, with key commodities such as oil, natural gas, aluminium, copper, and so on falling between -8% and -12%.

Within emerging markets, we are seeing strong divergent growth prospects from global large institutions, with China, the bellwether of growth for many years, having largely faded out due to disease outbreaks, geopolitical tensions, ageing demographics, property market turmoil, and cracks in the banking system. However, India has exhibited far greater resilience than in prior tumultuous years, mainly to financial flows supported by local institutions.

Domestic scenario

Domestic data has been encouraging on the macro level. Following the lead of global rivals such as the US Federal Reserve, the RBI hiked interest rates by 50 basis points for the fourth time in a row, bringing them to a three-year high of 5.9%. We are less affected than other Asian countries, with a -9.2% devaluation in CY22, compared to -12% to -13% in the Philippines, Taiwan, Thailand, and China.

Going forward, we expect the RBI to continue raising interest rates as a line of defence for currency stability and to battle growing inflation. According to the RBI, credit growth in the banking sector reached a multi-year high of 16.2% year on year for the week of September 9th, 2022. Credit growth has been driven by retail and SMEs. Due to a decrease in oil imports, the trade imbalance in August fell to $28.7 billion from record highs in July. However, in the face of global uncertainty, foreign investors were anxious and emerged as net sellers in the two weeks ending September 30th, as a rise in the US 10-year bond yield and a strong dollar index pushed FIIs to quit developing markets.

Conclusion

Our domestic economy is robust and stable. In comparison to worldwide counterparts, inflation is under control. Commodity price declines are assisting our predicament. Today, being cautiously hopeful is not a terrible thing. Going forward, as we approach the Christmas season, we anticipate that domestic demand recovery will continue, propelling discretionary expenditure in India after a two-year break caused by the epidemic. Sectors such as consumption, investments, and financials are projected to thrive in Q2FY22E earnings, but sectors reliant on global demand, commodities, and cyclicals may face operational pressure.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.