Date: 10 Nov, 2022

Global Scenario

The month of October was characterised by volatility across asset classes and throughout the world, particularly following remarks by Fed Chair Jerome Powell that it was "extremely early" to consider slowing rate rises, putting a damper on any residual investor expectations of a near-term pivot. The US Federal Reserve raised interest rates by 75 basis points to a range of 3.75% to 4%, the highest level since 2008. Concerns are growing that the Fed's efforts to reduce the cost of living may also push the economy into recession. On the other hand, Chinese stock markets rose on hints that the government is doing more to mitigate the effects of its Covid Zero programme.

Following a 0.6 percent decrease in the second quarter and a 1.6 percent slide in the first quarter, the US gross domestic product increased by 2.6 percent in the third quarter. Economists predicted a 2.4 percent increase in GDP. The growth was bolstered by a shrinking trade imbalance as well as improvements in consumer spending and government spending.

On the other hand, the US pending home sales index fell 10.2 percent to 79.5 in September after sliding 1.9 percent to a revised 88.5 in August.

The Bank of England raised interest rates for the first time in 33 years, following its worldwide counterparts in aggressive tightening to bring inflation down from double digits, despite the fact that the UK economy is expected to continue in a lengthy downturn. The Monetary Policy Committee of nine members resolved to boost the bank rate by 75 basis points to 3.00 percent from 2.25 percent.

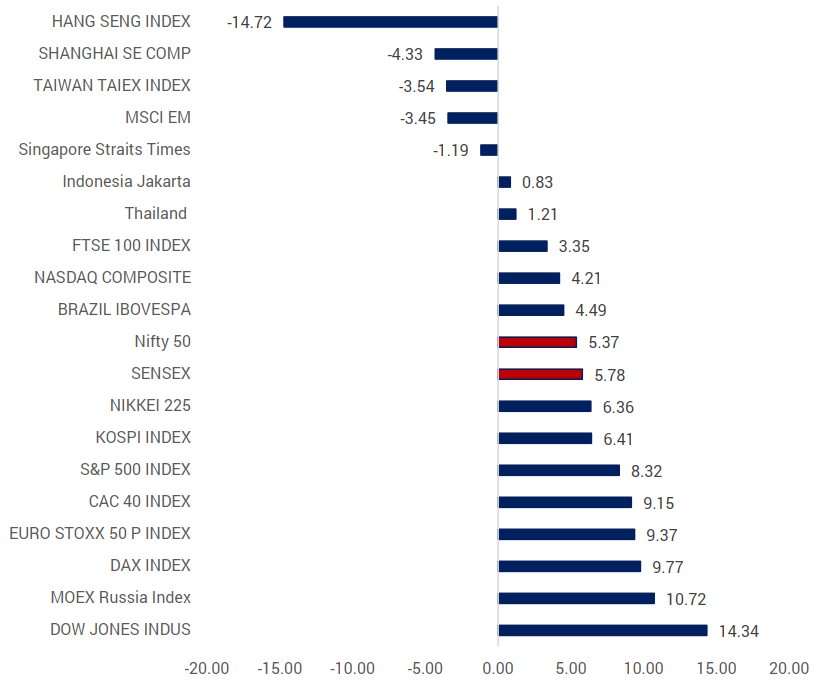

Figure 1 - World Indices Performances in Oct'22

The IMF's global economic predictions, revised at the end of October'22 during the semi-annual IMF/World Bank meetings, reveal that Advanced Economies are anticipated to increase by just 1.1% in CY23, with the US real GDP rising by 1% and the Eurozone growing by 0.5%.

In comparison, the IMF predicts that Emerging Markets and Developing Economies would expand at 3.7% this year and 3.7% next year, with China expected to accelerate to 4.4% growth in CY23 and India expected to grow at 6.1%.

Figure 2 - IMF World Economic Outlook, Oct'22

Domestic scenario

Following the trend of the majority of foreign indexes, the Nifty increased 5.4% in October 2022. India is at a crossroads in the global economic system. Interestingly, India has risen from the tenth to the fifth largest economy in the previous eight years and has the potential to become the third largest in the next eight.

The Q2FY23 earnings season is nearly over, and so far it has been in accordance with predictions. Growth was led mostly by BFSI, Autos, and IT, whereas Metals, Oil & Gas, and Cement saw declines throughout the quarter.

On the macroeconomic front, the current account deficit widened to $23.9 billion (2.8% of GDP) in Q1FY23, up from $13.4 billion (1.5% of GDP) in 4QFY22.

Food prices were once again blamed for the increase in inflation to 7.41% in September. Prices for grains, pulses, and vegetables continue to rise, according to high frequency statistics. Rural and urban inflation rose by 41 and 55 basis points, respectively, to 7.56% and 7.27%. For the ninth consecutive month, headline inflation has remained excessive and over the RBI's maximum limit of 6%.

Conclusion

Among other things, India's relative attractiveness in the medium to long term will be determined by 1) the manufacturing sector being a primary engine of growth (PLI and China+1), and 2) a private sector investment cycle resurgence powered by manufacturing sector growth.

We are in the midst of a period of increased global news flow, events, and uncertainty. Financial conditions have tightened as a result of strong monetary policy actions taken throughout the world to counteract an increase in inflation. This has increased volatility in financial markets, and the US dollar has surged to a two-decade high. The INR has been one of the best performing currencies in relation to the USD. Domestic demand remained solid, with credit growth accelerating to 16.2% year on year. Moving away from EM funds and China funds and toward India-specific funds is also gaining traction. This influx should strengthen Indian stocks in the medium to long run.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.