Date: 13 Mar, 2023

Following a strong start in January, US equities fell back in February 2023, driven by higher-than-anticipated inflation, stress in the real estate market, and new highs in retail sales statistics. Given that the Fed Funds Rate is now between 4.5 and 4.75 percent, the consensus is raising its forecast of the Fed's terminal rate to 5.5% in February 2023 from 5% in January 2023 due to increased inflation. Finally, it has begun to give a lesser probability to the rate decrease in CY23E.

In February, eurozone stocks continued to rise. Forward-looking data painted an encouraging picture for the eurozone economy. The February flash Markit composite purchasing managers' index increased from 50.3 in January to 52.3 in February, signalling the largest uptick in corporate activity since last May.

The primary refinancing rate now stands at 3.0% after the European Central Bank (ECB) increased interest rates by an additional 50 basis points (bps). In March, another rise is anticipated.

With the official manufacturing PMI rising from 50.1 in January 2023 to 52.6 in February 2023 (the highest figure since April 2012), the reopening of the Chinese economy is starting to have an effect. Official data showed that new orders picked up for the first time since in April 2021. Additional signs that point to a rise in domestic demand include house sales (which had their first increase since June 2021 in February 2023), air passenger traffic (+35% in January 2023), subway ridership, and passenger car sales. As a result, Moody's raised its GDP prediction for CY23 from 4% to 5%.

The forecast for the global economy in CY23 has significantly improved since the beginning of the year, according to OECD Secretary-General Mathias Cormann, compared to what was anticipated around the end of CY22. He listed a number of causes, including the sharp drop in energy and food costs, Europe's diversification of energy sources, the strength of the US and Asian economies, and China's openings. He did, however, caution that the battle against inflation is not yet over and that in order to reduce inflation to the desired levels, international central banks would need to continue enforcing strict monetary policies. In February 2023, the global manufacturing PMI increased to 50 for the first time in five months (49.1 in January 2023).

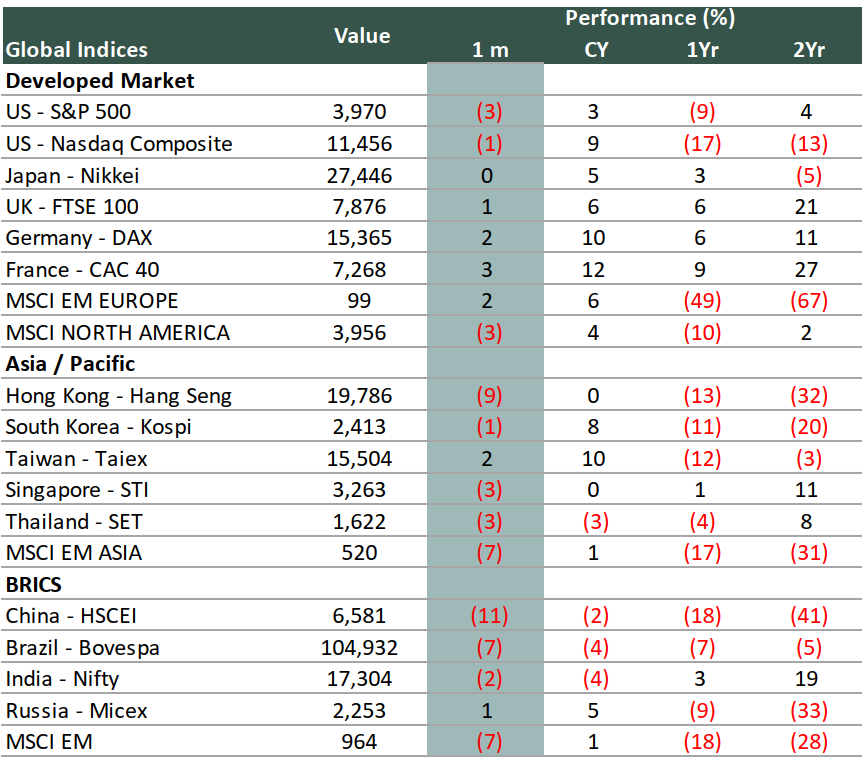

World Indices % Performance in February 2023

1- Source: IDBI Capital, Bloomberg

On currency side, USD dollar has appreciated against other currencies in the month of Feb-23 with Dollar Index increasing by 3% MoM. In the past two years dollar index has appreciated 16%.

Indian currency appreciated 1% vis- à-vis USD while other currencies such as JPY, CNY, AUD, GBP depreciated 1-4% against the USD.

Domestically, February was a particularly interesting month for the Indian stock markets. Wild stock movements with key Adani Group companies hitting their upper and lower circuits throughout the month, thanks to Hindenburg’s report alleging corporate misgovernance and alleged fraud by Gautam Adani, kept stock market participants on their toes. The volatility in the Adani Group stocks were met with uncertainty on the plausibility of rate hikes pausing anytime soon, inflation persisting beyond targeted levels and Russia-Ukraine war seeing no sight of resolution.

Some notable releases during the month were:

We think the best approach for equities investments might be domestic market-driven themes. The consumer sector hasn't been doing well lately, but local demand appears to be picking up, which gives some valuation comfort. Throughout recent quarters, capex has continuously seen solid traction on both the public and private fronts. The increase in consumption and expenditure is also helping the credit/financial sector, which is resulting in double-digit loan growth with historically low credit costs, suggesting a mid- to long-term tailwind opportunity.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.