Date: 12 Jun, 2023

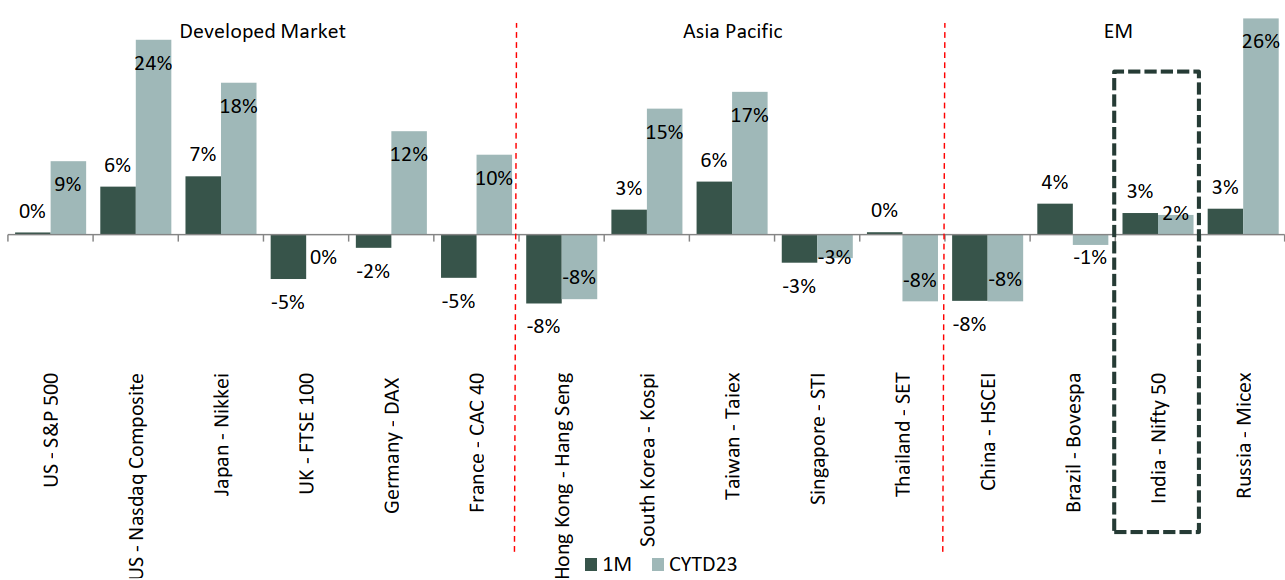

May month ended with yet another mixed bag note. US’s Nasdaq rose 5.8% MoM whereas Dow Jones ended -3.5% MoM as fears loomed over Congress passing a tentative deal on raising US debt ceiling whereas gains were seen across mega cap tech stocks after Nvidia gave an encouraging outlook based on AI potential. Nikkei rallied to 20 months high at 7% MoM as investors cheered chipmaking investment plans and reasonable April trade data. In European counterparts, shares hit a two-month low as concerns about a global slowdown on account of China's weak economic data and uncertainty around the U.S. debt ceiling outpaced optimism from signs of easing inflation in some major euro zone economies. Lastly, China Index fell as investor sentiment was broadly subdued with market focus on the Sino-U.S. tensions.

The likelihood of another interest rate increase in the US is debatable, but we think a pause is more reasonable. Macros appear to be getting better, and inflation appears to be heading downward.

According to estimates, US markets will rise over the upcoming months as core PCE inflation is expected to drop to between 2.6% and 3.6% in the future months. That is nevertheless higher than the extremely low levels from the decade immediately after the 2008 financial crisis. The three-year-old openness of China after the zero-tolerance Covid-19 measures is now losing velocity, which is a worrying development for the financial markets.

Some of Asia's other big countries are starting to stand up as attractive choices for foreign investors as dissatisfaction with China's equities performance rises. A comeback of inflation in Japan, increasing spending in India, and promising futures for the world's top chipmakers in Korea and Taiwan are among the tailwinds propelling their equities at a time when China indices are falling behind the rest of the globe. Japan has received foreign investment for seven consecutive weeks as of mid-May, while Korea and Taiwan have each received at least $9.1 billion this year.

While it is almost certain that BoE and ECB will be hiking rates in their Jun’23 policy meetings, Fed’s stance still remains unclear. Reserve Bank of Australia is also expected to hike rates in Jun’23 as inflation has surprised on the upside in Apr’23. BoJ on the other hand has reiterated to maintain its ultra-loose monetary policy stance.

Domestically, Indian stocks maintained their upward trend from the previous months, rising 3% MoM in May. There were no significant unfavourable shocks during the earnings season. As a result of the RBI's unexpected halt, domestic financial conditions improved. Additionally, the impetus was increased by FPI flows and global tailwinds. In our opinion, reasonable values also served as a trigger.

Flows into Indian equities picked up pace - FIIs buying USD ~5.3 bn worth of Indian equities, highest monthly buying since August 2022. FIIs have now been net buyers for three consecutive months. DIIs were marginally negative to the tune of USD ~0.4 bn.

The RBI raised the policy repo rate cumulatively by 250 bps between May 2022 and February 2023, while shifting its policy stance to withdrawal of accommodation to lower inflation and bringing it within its target. Although negative risks are anticipated to persist until CY23, the cycle of monetary tightening is almost at its peak. The MPC maintained its 6.5% YoY projection for FY24 GDP growth while only slightly lowering its 5.2% YoY estimate for inflation to 5.1% YoY.

According to statistics from the Reserve Bank of India, or RBI, consumer sentiment continued to rise in May 2023, rising by 220 basis points to 87%, as a result of more favourable perceptions of the economy's overall health, employment opportunities, and household income. Consumer sentiment increased by a total of 17.4 percentage points throughout these five months.

India's GDP growth in the March 2023 quarter surprised pleasantly at 6.1% yoy vs the consensus forecast of 5%. The expansion in the construction, trade, hotel, and hospitality industries on the supply side and the considerable traction in fixed investments and exports on the demand side are mostly responsible for the performance's better-than-expected results. The significant drop in imports was also beneficial. We anticipate that the rise in private final consumption expenditures will boost GDP growth when the rate of inflation starts to decline.

Looking at result season gone by, Mar 2023 quarter EPS posted a muted 2% yoy growth, after being in the negative zone for previous two quarters. The sharp deceleration in EPS momentum seems to have turned around in the Mar 2023 quarter, as gross margin continued to improve qoq. Adjusted for one-offs, Nifty-50 companies’ profits rose by 7.5% yoy in the Mar 2023 quarter, driven by financial services, automobile, FMCG and infrastructure sectors. However, the major laggards on the PAT front were metals, chemicals, healthcare and power sectors. Considering that a smaller proportion of companies extended their sales beat during the quarter, the PAT beat seems to have come from the EBITDA margin improvement.

Going ahead, we do expect GDP growth should stay within 6-6.5% zone for FY24 which in itself would be strong resilience after showing such growth performance in last 2 years. Interest rate cuts are around the corner over next 2-3 quarters which will create positive confluence for our Indian equity markets as on FY23 basis, valuations seems reasonable. Economy stands at solid footing for a better second half of CY23, however there could be some effects of El-Nino impacting our monsoons and remains key monitorable item over coming months. Markets are catching up on pricing post earnings season and the momentum is only expected to grow stronger from here on. Any global event led correction should be used as a opportunity to add going ahead.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.