Date: 12 Jul, 2023

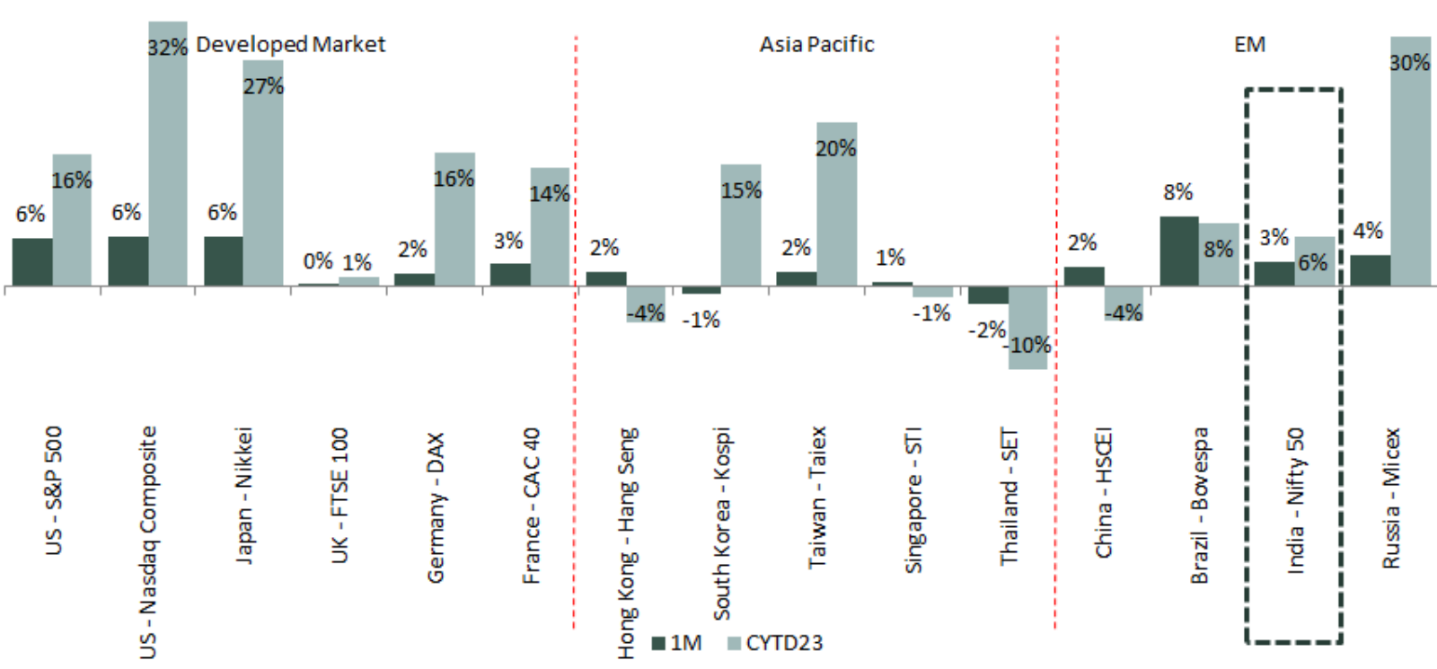

June month ended on positive note. US indices and emerging market indices continued to do well, while European indices returns remained muted. S&P-500 is up 6% MoM and CYTD23 its up 16%.

With the exception of Europe and the UK, inflation continues to decline fast across all economies globally. In the US, the May CPI increased by 4% YoY, which was in line with expectations but much less than the June 2022 peak of 9.1%. In India, the CPI for May 2023 was 4.25% YoY, which was about in line with market expectations. Inflation in Europe and the UK decreased but is still high. Preliminary figures for the Eurozone's inflation showed that it was 5.5% YoY in June 2023 as opposed to 6.1% in May, while in the UK it was 8.7% YoY in May 2023. The recent decline in commodity prices, the reduction of the energy inflation shock, and the high base have all contributed to the recent decline in inflation.

- 1 Source: IDBI Capital

According to estimates, US markets will rise over the upcoming months as core PCE inflation is expected to drop to between 2.6% and 3.6% in the future months. That is nevertheless higher than the extremely low levels from the decade immediately after the 2008 financial crisis. The three-year-old openness of China after the zero-tolerance Covid-19 measures is now losing velocity, which is a worrying development for the financial markets.

Globally speaking, monetary policy decisions in June were inconsistent. Although the US Fed did not raise rates, it did signal that it will do so again (for a total of 50 bps) this year. This is in contrast to the Fed's prior signal, which stated that it would stop raising rates after the significant 500 bps increase. The Bank of England increased interest rates by 50 basis points, which was more than the 25 basis points forecast. Even when accounting for the low base impact, China's GDP data still shows a lacklustre performance. As the real estate sector continues to suffer, the Chinese central bank lowered borrowing rates to spur growth.

The US employment market is still strong, with 9.9 million new positions available in May 2023 compared to 10.1 million in April 2023. Data points in China show a worse than anticipated economic rebound following the Covid lockdowns. Retail sales in China increased by 12.7% YoY in May 2023, however they fell short of expectations and notably behind April 2023 figures. IIP in China decreased dramatically, from 5.6% YoY in April 2023 to 3.5% YoY in May 2023.

Domestically, the Indian stock market saw a significant rise in the next four months, which enabled both indexes reach new highs on the last session of June 2023 (CYTD Nifty was 6%), after offering zero return in the first two months of the current year (CY) 2023. We witnessed a widespread rise that was driven by strong inflows of foreign capital, moderated crude oil prices, and a steady improvement in India's macroeconomic outlook, i.e., reduced inflation, better than anticipated current account deficit statistics, and lower raw material costs, all of which contributed to increased corporate profitability.

Among developing markets, India is thought to have had the greatest equities inflow in June. One of the main factors fueling the current market rise is a resurgence of FII confidence in the Indian market. The largest inflow into Indian shares since December 2020, $12.5 billion, came from foreign institutional investors in the June quarter as a result of strong earnings growth and positive macroeconomic indicators.

The minutes of India's MPC (Monetary Policy Committee) from June showed a hawkish stance amid uncertainty around the inflation forecast (due to rising risks associated with a bad monsoon). But following widespread flooding over the past few days in many sections of the nation, the threat of El Nino, which had been a major short-term worry, now appears to have subsided. The governor of the RBI stated that a decline in inflation to 4% is likely to be slow and lengthy. Risks to food inflation are tilted to the upside due to the growing unpredictability surrounding the monsoon season.

Recent high frequency data indicate that India's growth momentum is still strong. Be it the demand for cement (+15.5% YoY), e-way bill registrations (+15.5% YoY), GST collections (+11.7% YoY), or salary increase (+13.5% YoY). Durables demand is somewhat subdued even if FMCG consumption has increased, driven by rural India.

Moving forward, we remain optimistic about the market for the foreseeable future, but there could be certain risks and concerns in the upcoming one to two quarters that we need to be aware of. Despite the fact that Small & Mid cap indices are trading at all-time high levels, it is crucial to avoid index investing and instead adopt a bottom-up stock-picking strategy and focus on businesses that benefit from any of the dominant long-term themes, such as financialization of savings, import substitution, capital expenditures, green energy, digitalization, consumption-led, etc.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.