Date: 10 Jan, 2023

The global economy battled on numerous fronts in 2022, including rising inflation in key global economies, the Russia-Ukraine conflict, which caused supply chain and energy disruptions, monetary policy tightening by global central banks, prolonged pandemic difficulties, and so on. With the world economy under strain, India outperformed the other major developed markets.

After a reasonably steady rise in October and November, December proved to be turbulent. The planned Santa rally did not take place. Instead, markets crested early, setting a new all-time high, and then declined throughout the month, particularly at the conclusion. Geopolitics, valuation concerns, profit trajectory, and domestic macroeconomics all had a role in the decline.

Global commodities prices peaked in April of this year and have since progressively declined. Crude oil prices have fallen 33% since their high in June of this year; it is one of the primary commodities with budgetary repercussions for emerging market nations.

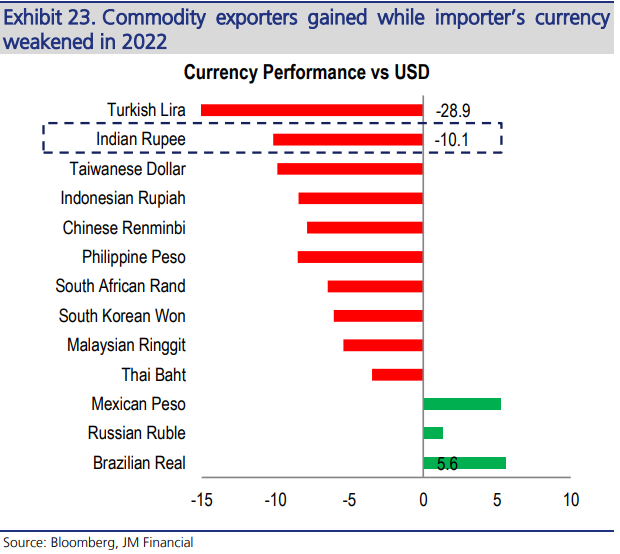

The INR's performance (-10%) in 2022 was mostly due to the stronger USD rather than INR weakening. The surge in the DXY was mostly driven by macroeconomic variables such as the US's decadal high inflationary trend and the US Fed's hawkish policy moves. As the uncertainties surrounding geopolitical disputes and the global downturn became obvious, the dollar's safe haven position intensified the surge even more. India's forex reserves fell by $ 83 billion in 2022, as markets expected, as a result of the RBI's FX market intervention to protect the INR. 67% of the depletion in the forex reserves was due to valuation changes arising from strengthening USD and higher US bond yields.

Source 1 - Bloomberg, JM Financial

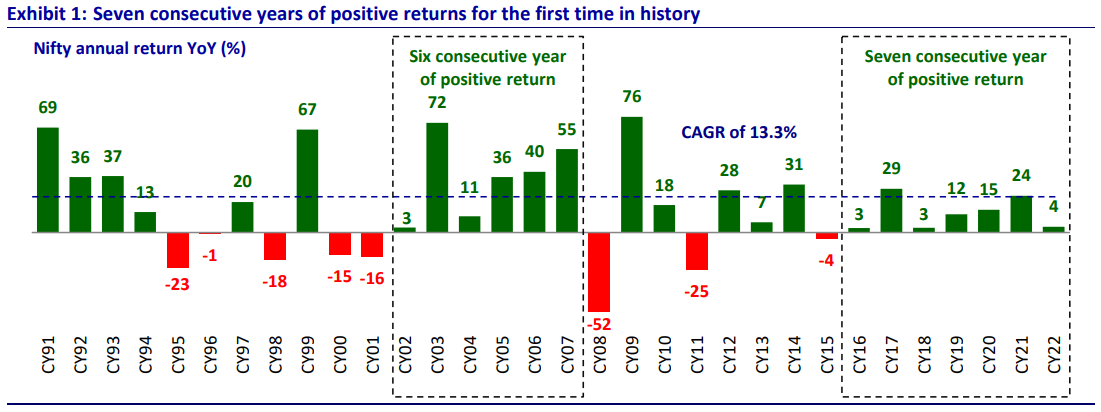

Domestic equities markets held up well despite substantial FII selling, thanks to domestic flows. Most intensive FII selling lasted for nine straight months from Oct'21 to Jun'22, totalling $36 billion (of which $12 billion has been recouped to far); the Nifty lost 10% during this period. However, despite FII flows of - $18 billion in 2022, the Nifty gained 4.87%. This marked a seven consecutive year of positive returns for first time in its history.

Source 2- MOSL

We are also mindful that the 2022 bounce may not be completely sustained in 2023 due to the numerous uncertainties ahead.

- 2022 was the first post-Covid year that was totally functional, with no influence from lockdowns. This pushed up growth rates, not just from the low-base impact, but also because of a boom in "revenge spending". In 2023, a more normalised demand situation may cause an apparent slowing in growth.

- The global economy, driven by the United States and Europe, is anticipated to slow considerably as interest rates rise. This is expected to have an impact on export sectors, which may see weaker demand and possibly pricing pressure. The most likely scenario is that the Fed's rapid rate rises will produce a mild recession in Europe and the United States. If the growth impact is greater, the markets may be exposed to a big downturn. This would trigger both an earnings and valuation correction and India, despite the strong domestic economy, would not be immune.

Domestically, we expect a broader market rally in CY23. First, worries around the macro should start to ease, especially around macroeconomic and financial market stability. This should reduce risk aversion and spur wider participation in the markets. Second, earnings growth for FY24 is expected to be broader based than in FY23.

The Union Budget for FY24, scheduled on February 1st, will be the next major event. The budget's direct relevance has diminished due to the long-term nature of economic policy, but it will remain an essential marker of the government's approach in the run-up to the general elections in 2024.

To summarise, it may appear difficult to get stellar returns in 2023, but one must be selective and wise in terms of sector rotation and a bottom-up strategy. We believe that the large-cap space is majorly priced in, and that there are new opportunities in the mid and small-cap space to be played out in this year.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.