Date: 14 Feb, 2023

At the start of CY23, the global economy is sending contradictory signals. In the United States, the majority of macroeconomic statistics (home sales, factory activity, retail sales, and consumer confidence) are slowing, but the labour market remains tight. However, activity in the Eurozone is likely to improve (Germany Ifo, PMIs), and CPI is predicted to have peaked last year. Following the government's decision to reopen the economy, both manufacturing and service activity in China have recovered, with the services sector benefiting the most. Taking these new developments into consideration, the IMF has raised its global growth outlook for CY23 to 2.9% from 2.7% before. However, it has reduced its CY24 projection to 3.1% from 3.2%.

Global stock indexes rose in January-23, with the S&P-500 index up 6% year on year, while the IT/tech heavy Nasdaq excelled with an 11% year on year gain.

The US dollar fell against foreign currencies in the month of January-23, with the Dollar Index falling by 1% month on month. This is despite a 7% drop from November to December 22.

The US Federal Reserve, the European Central Bank, and the Bank of England all opted to raise their main policy rates at their most recent policy meetings. While the Fed slowed its rate hike to 25 basis points, the BoE and ECB continued their pace and raised rates by 50 basis points. In terms of future guidance, the Fed has maintained that it is unlikely to lower rates in CY23 since the labour market remains tight, putting upward pressure on CPI, which has just begun to moderate. The Bank of England has become more dovish, believing that the economy would not slow as much as previously projected. The ECB has also pledged to keep raising rates unless the CPI falls significantly. The Bank of Japan, on the other hand, has confirmed its ultra-easy monetary policy stance, predicting that inflation will fall below the 2% goal by the middle of fiscal year 2023.

Domestically, core sector growth for December was 7.4%, bringing the overall figure for the first three quarters to 8%. Except for crude oil, all categories had positive increase. CPI inflation fell to a 13-month low of 5.7% in December, down from 5.9% in November.

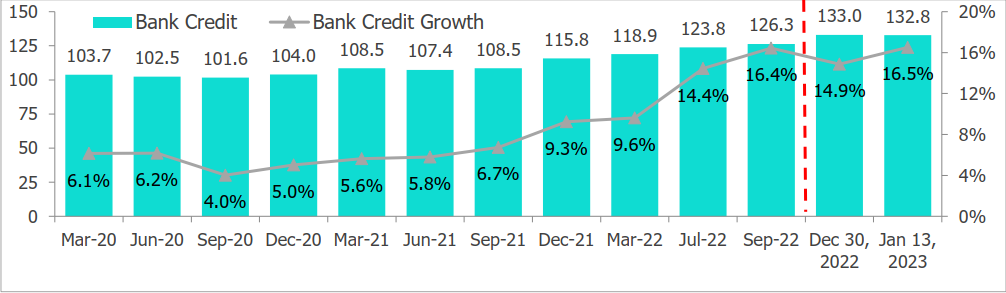

Credit offtake increased by 16.5% year on year during the two weeks ending January 13, 2023, compared to 8.1% for the same time last year (reported January 14, 2022). The expansion has been fuelled by sustained retail credit (due to the miniaturisation of credit, vehicle loans, consumer durables, and credit cards), inflation-induced higher working capital demand, lower borrowings from the capital market and overseas markets, NBFC borrowing shifting to the banking system due to cost optimisation, credit demand for capex, and growth in MSMEs. Credit growth has remained in the double digits in recent months, despite the large hike in interest rates.

Bank’s credit growth (Rs. L Crs, % yoy)

- 1 Source: RBI, CareEdge

- 1 Source: RBI, CareEdge

Budget 2023-24 - #SabkaSaathSabkaVikas

This year's budget was growth-oriented while being conservative and keeping the fiscal deficit at 5.9%. Some of the highlights were inclusive growth, devoting 33% of funding to capex, extending support to Agri & MSME through credit guarantee plan, and providing relief to taxpayers by rationalising tax rates. In contrast to market expectations, the administration has combined inclusive growth with prudent fiscal discipline.

Budget also pleased the market by not exaggerating gross borrowing figures, resulting in a drop in 10-year rates. MSMEs were the focus of the sector, whether it was providing them with digital lockers, integrating them into the value chain, or reforming the loan guarantee plan with a Rs 9,000 crore corpus.

Some highlights were:

The Centre's capital investment is estimated to rise by 37.4% in FY24BE to Rs 10 lakh crore, compared to a 22.8% growth in FY23RE.

The fiscal deficit objective for FY24 (BE) is 5.9%, which is consistent with our forecast of 5.75-6%. FM said frequently in her address that the goal would be to restore the fiscal glide path of less than 4.5% by FY26.

Revenue spending is predicted to be reduced, with just a 1.2% growth in FY24BE to Rs 35 lakh crore, compared to an 8.1% increase (Rs 34.6 lakh crore) in FY23RE.

Disinvestment revenues are expected to be marginally higher in FY24BE, at Rs 51,000 crore, compared to Rs 50,000 crore in FY23RE.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.