Date: 15 Dec, 2023

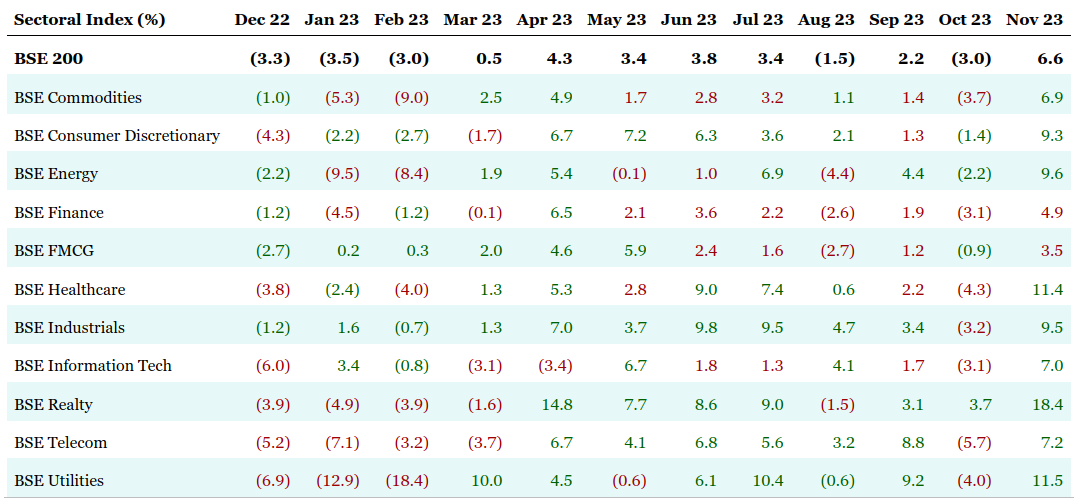

Nifty gains through November: The Nifty recovered in November 23 with a 5.5% MoM gain after consolidating in October 23. The index was notably quite volatile, swinging between 1,185 and 1,054 points before closing at a higher level. Together with robust institution flows, investors continued to believe that the US Federal Reserve had completed its cycle of rate hikes, which helped the domestic and international markets recover intelligently. In November, interest rate risk and geopolitical threat became neutral. The severity of the Israel-Hamas conflict has decreased, and crude prices have cooled due to greater reserves and a prospect of lower demand. In November 23, midcaps and small caps performed 4.9%/6.5% better than large caps. In a similar vein, midcaps and small caps have increased 36%/46% compared to the 11% increase for the Nifty in CY23YTD. They have outpaced large caps.

Source: B&K Securities

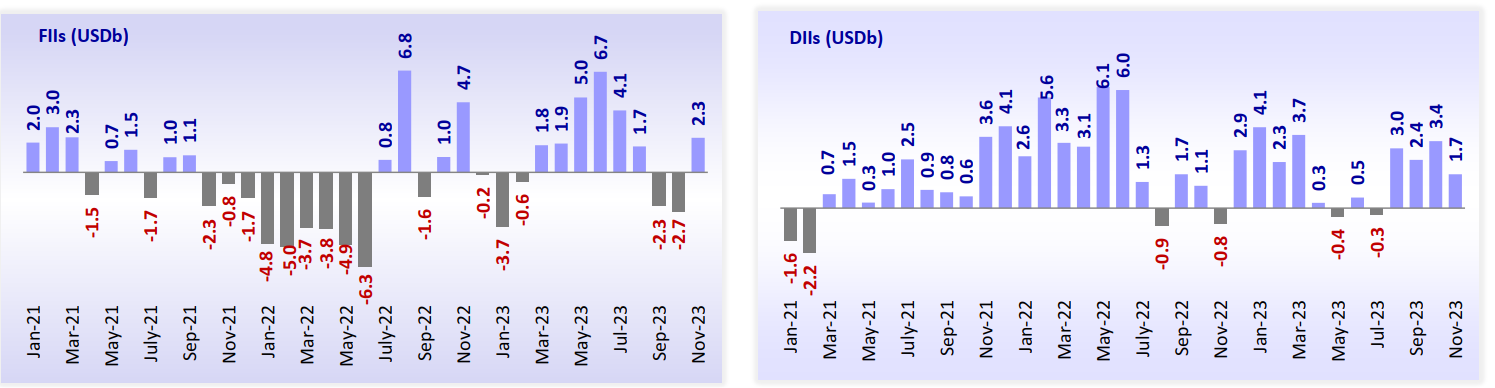

Flows: Following two consecutive net negative months, FIIs turned net buyers again in the Indian equities cash market, with net buying of $2.3 billion. CYTD inflows totalled $14.2 billion. However, domestic institutional investors (DIIs) continued to be net purchasers in November 23 with net purchases of $1.7 billion, and CYTD inflows were $20.7 billion as SIP monthly flows were robust at Rs. 16000 crs compared to Rs. 13000 crs on a year-over-year basis.

Source: MOSL

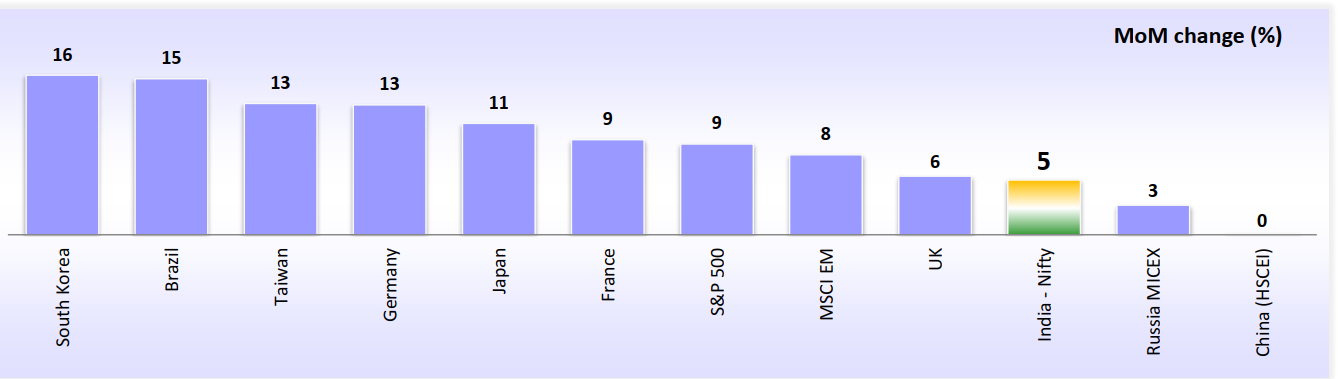

Global: The majority of world markets rose on November’23; South Korea leads, while China continues to trail behind during the month. The Nasdaq achieved a robust double-digit gain of 10.7%, while the S&P 500 gained 8.9%. In November’23, benchmark indices in the UK (FTSE 100), France (CAC 40), and Germany (DAX) increased by 1.8%, 9.5%, and 6.2%, respectively. In terms of policy, the US Federal Reserve maintained its 5.25–5.5% policy rate at its meeting in October/November 23. The Fed Chair has remained silent on rate cuts for the time being. In its Nov. 23 announcement, the Bank of England (BoE) maintained its policy rate of 5.25% for the second time in a row since Dec. 21. Six of the nine members chose to wait, while the remaining three voted in favor of a 25bps raise. Therefore, the result was not unanimous. After rising rates ten times in a row since July’22, the European Central Bank (ECB), like other major central banks, opted to take a break during its meeting on October’23. The president of the European Central Bank (ECB) has reiterated that restrictive monetary policy is anticipated to continue, and that rate reduction are not already factored in. The Bank of Japan has persisted in maintaining an extremely loose monetary policy.

Source: MOSL

State Elections Results: Contrary to exit polls prediction, Bhartiya Janta Party (BJP) comfortably won in three out of five states that went to polls. BJP reclaimed Rajasthan and Chhattisgarh from the Indian National Congress (INC) and extended their majority in Madhya Pradesh (MP) by over two-thirds majority. INC defeated incumbent Bharat Rashtra Samiti (BRS) in Telangana and in Mizoram newly formed 4 years old Zoram People’s Movement (ZPM) defeated incumbent Mizo National Front (MNF). Thus, all five states have received a clear verdict. Together, these five states hold 76 of the 544 Lok Sabha seats.

GDP: In Q2FY24, India's GDP grew at an impressive 7.6% annual rate, exceeding market forecasts. The information supported the claim made by international agencies time and again that India's economy is expanding at the quickest rate in the world. In this succinct study, we contrast India's GDP growth in the quarter that ended on September 23 with that of other global big economies. The International Monetary Fund (IMF) predicted in October 23 that India's major economy will grow at the quickest rate in the world. Although the IMF projects 6.3% GDP growth in India, future adjustments to this estimate are probably going to be biased higher.

Q2FY24 Corporate Earnings: The corporate earnings for 2QFY24 ended on a positive note marginally beating market expectations. Overall, it was widespread outperformance across aggregates driven by margin tailwinds. Domestic cyclicals such as Automobiles, BFSI, and Cement drove the beat. Nifty delivered a beat with a 28% YoY PAT growth. However, rural demand continues to sluggish which was reflected in muted topline growth in consumer oriented sector. Five Nifty companies - BPCL, HDFC Bank, Tata Motors, JSW Steel, and Reliance Industries - contributed 68% of the incremental YoY accretion in earnings. Going forward margin tailwind will moderate in the second half of FY24 due to the base effect and an increase in certain commodity prices would be key to watch out for.

Wave of IPOs: The number of issues has nearly doubled in the last five years, contributing to the expansion of the IPO market. In addition, the total issue size increased during these years, rising from Rs 16,754 crore in 2018 to Rs 1,38,894 crore in 2021–2022. Presently, the total issue size for the year is Rs 37,768 crore, with participation from more than 200 enterprises across various industries. More than eighty-two of the 96 companies that had an initial public offering (IPO) in 2022 had registered at flat or premium prices; as a result, investors received listing gains through the subscription. However, 14 of them had a discount stated. The industries that have contributed the most this year in terms of issue size include, to mention a few, the pharmaceutical, trading, port, hospital & healthcare services, and retail sectors..

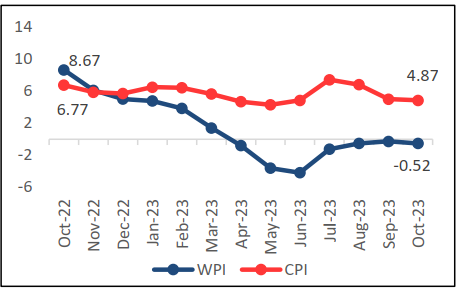

Inflation: October's CPI inflation rate decreased to 4.87% from 5.02% in September. The retail inflation rate was slightly higher than the 4.80% overall prediction. Food costs increased at a level rate, with the lowest rise coming from vegetables, which saw a drop to 2.7% from 3.4%. Cereal prices, on the other hand, stayed resilient at 10.7% from 10.9%, while the inflation of pulses increased to 18.8% from 16.4%. We anticipate that the CPI will steadily reduce towards the 4% target level, notwithstanding some rocky patches. For the past 14 months, cereal inflation has already consistently been in the double digits. In the near future, this will be a crucial factor to monitor for the overall inflation outlook.

Source: HDFC Securities

Currency: Lately, the INR has been trading in a small range. INR is one of the few currencies that was unable to benefit from the dollar's drop, even though the majority of other currencies increased at the expense of the dollar. Since investors do not anticipate any further rate hikes from the Fed, most currencies have strengthened relative to the US dollar. Amid a slowdown in the US economy, especially in the housing and job markets, and a cooling of inflation, expectations have grown about potential rate reductions beginning in early 2024.

Yield: India’s 10Y yield fell at a slowest pace compared to its major peers. The moderation in yield was arrested by tighter liquidity conditions. Global yields got comfort from expectation of easing financial conditions in the coming year. CME Fed watch tool is pricing in a rate cut by Fed from Mar’24 onwards. Even yields in major EMs noticed a sharp correction in Nov’23. Inflation is showing signs of moderation in major economies on the back of stable energy prices.

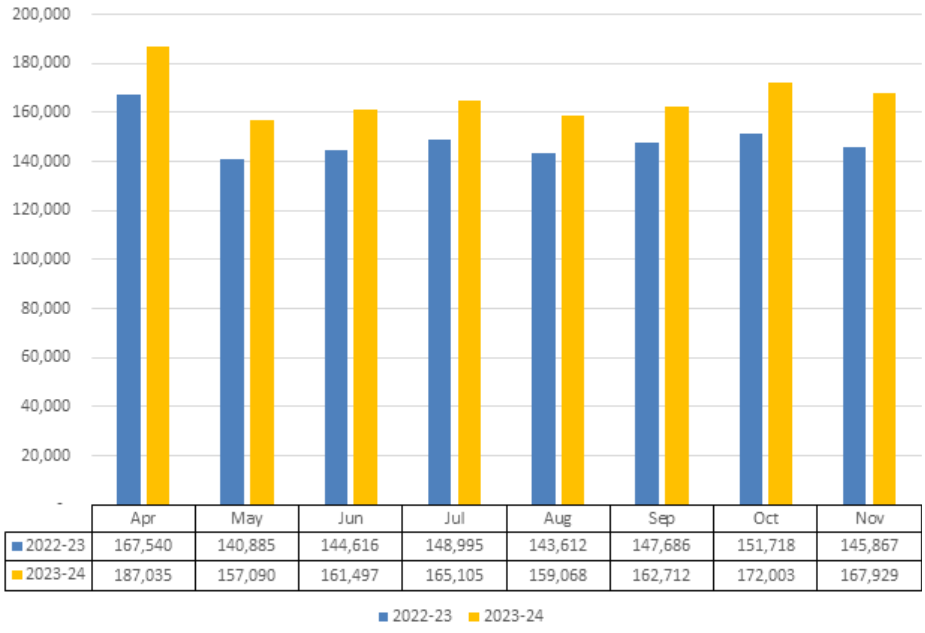

GST: Although sales were boosted by the holiday season, Goods and Services Tax (GST) revenues in November reached Rs. 1.68 L crs, which was less than October's receipts of Rs. 1.72 L crs. The robust tax revenue collection coincides with the rapid pace of GST-related audits over the first several years of the indirect tax reform. The average monthly GST receipts are currently Rs. 1.66 L Crs, which is somewhat more than the policymakers' initial projection of Rs. 1.65 L Crs. The total growth from April to November comes to 11.87%, which is more in line with the nominal 10.5% annual economic growth rate anticipated for this year.

Source: PIB

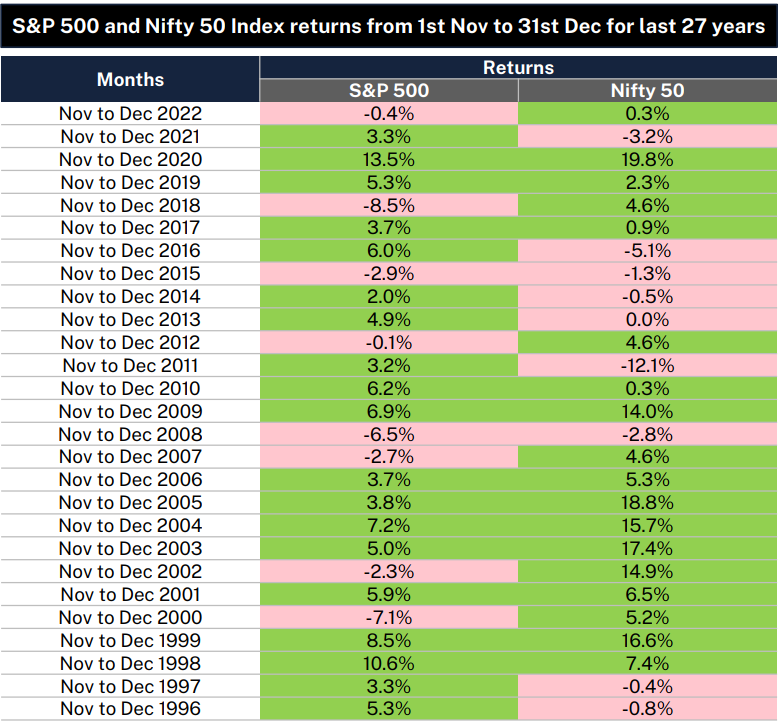

Santa rally in offing: Over the last 27 years, there have been 19 rallies in the S&P 500 index with an average return of 5.7%, and 18 rallies in the Nifty index, which is known as the Santa Rally, with an average return of 8.9%. After a downturn in response to geopolitical concerns in the Indian markets from mid-September to end-October, there has been a comeback in momentum beginning in November. Strong economic activity, impressive H1FY24 data, and government capex-led growth all point to a favourable macro environment in India, which is supporting the country's generally upbeat market sentiment.

Source: Spark Capital

Fund Manager Commentary:

Equity market gained 5.5% in month of November, continuing its upward momentum on back of 2QFY24 earnings ending on positive note, Both FII & DII flows were positive, macro data (GST, E-way bills, PMI etc) continues to show optimism. Also, news & data flow from global market indicating US Federal Reserve near its peak rate cycle led to optimisim in both domestic and global markets. Recent state election win by BJP in 3 out of 5 states has further reinforced market expectations for political continuity in 2024. We believe improving economic fundamentals along with political stability would aid in faster economic development. Through our YUVA Bharat PMS strategy, we endeavour to participate in India growth story.

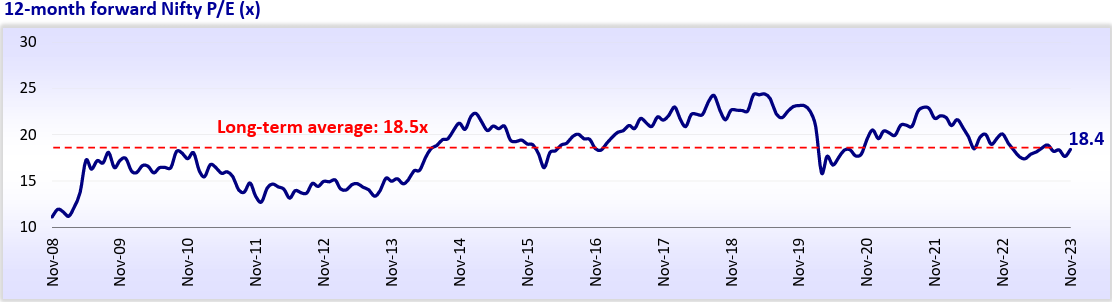

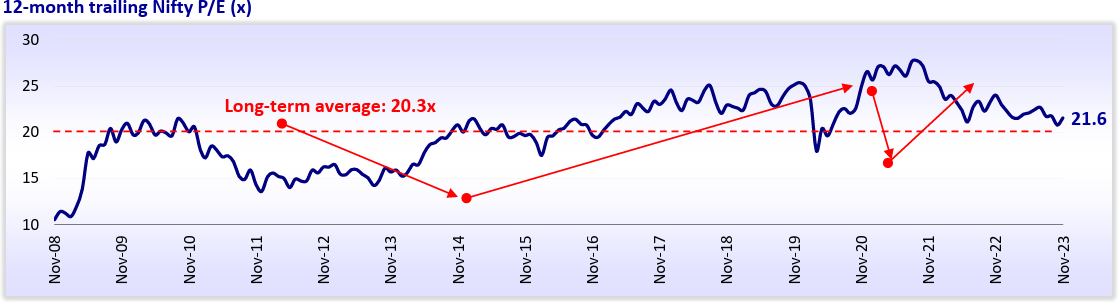

Equity markets after remaining range-bound over the past 20 months, has finally broke out of range and surpassed the previous highs in Jul’23. While markets optically are at all-time high, in terms of earnings during the same period from FY21 to FY23 nifty earning has expanded from Rs. 542 to Rs. 807 a CAGR of 22% over the same period, thus on relative basis valuation are relatively reasonable compared to Oct 21 peak. Nifty currently is trading marginally higher than its long period average at 21.6x on 12- month trailing basis, while on 12 month rolling forwards basis at 18.4x it is near its long period average. Equity markets were anxious about the outcome of state polls and what it infer for the 2024 general elections. With the outcome overwhelmingly in favor of the incumbent BJP, the confidence of the market in the current dispensation and political continuity post 2024 Lok Sabha elections will get a boost. This augurs well for macro and policy momentum for India, which, at the moment, is seeing the highest growth among major economies (both GDP as well as corporate earnings). However, we keep cognisance of global concern on inflation and rates, Ongoing conflict between Ukraine and Russia. We believe Time in market is more important than timing the market from long term wealth creation.

Source: MOSL

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.