Date: 09 Dec, 2022

Global scenario

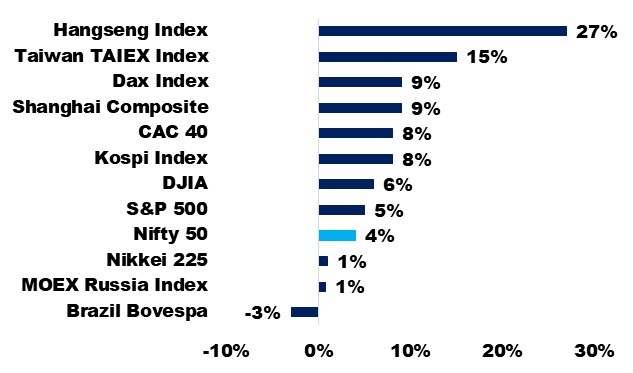

Investors were cautious at the start of the month due to persistent inflationary concerns and tighter regulations. However, the month of November saw a shift from volatility on a negative bias in markets to bullish rebounding across various markets. The S&P500 in the United States increased by 5.38%, the DAX in Europe increased by 8.6% on a month-to-month (mom) basis, and the Hang Seng in Hong Kong increased by a stunning 26.6% amid signs that China may soon exit from Covid-Zero policy and measures by Beijing government for its troubled realty sector.

The Fed raised interest rates for the fourth time in a row, to 4% (the highest level since 2008), but US consumer prices fell to 7.7% mom from 8.2%. However, Jerome Powell did imply that the pace of future interest rate rises will be slowed. The US economy gained 200K jobs in November, one of the weakest employment gains since December 2020, but this came against the background of several firms, particularly tech, announcing layoffs. The unemployment rate remained stable at 3.7%, while wages increased little by 0.3%, showing a return to normalcy in the labour market following the pandemic shock.

OPEC+ nations including Russia, decided to stick to its status quo of restricting supply of 2 million barrels per day i.e. ~2% of world demand. This came in announced post European Union announcing complete ban and G7 nations set a price cap of $60/bl on Russian Seaborne Oil. Today India imports ~21% of its oil from Russia.

Figure 1 - World Indices Performances in Nov'22

Domestic scenario

The Reserve Bank of India hiked its benchmark lending rate by 35 basis points, the fifth rise since May 22, adding that "it remains focused on bringing inflation to a reasonable range."

We feel that the tightening cycle is nearing its end. We do not expect rates to rise by more than 25 basis points from here, and interest rates should peak in 1QCY23.

The growth forecast for FY23 has been reduced from 7.0% to 6.8%. Inflation is expected to remain at 6.7% in FY23.

Consumer confidence has increased over multiple quarters in terms of growth. The most significant threats to the forecast continue to be the effects of persistent geopolitical tensions, a global downturn, and tighter global financial conditions. Taking all of these factors into account, real GDP growth is projected to be 6.8% in 2022-23, with Q3 at 4.4% and Q4 at 4.2%.

On the index front, the Nifty climbed 4% in November 2022, following the trajectory of the majority of overseas indices. In November 2022, 36 of the Nifty members finished higher, with roughly 50% outperforming the benchmark. On a year-to-date basis, 64% of Nifty members are trading higher.

In the month of November 22, the gross GST income collected was Rs. 1.46 L Crs. This is the seventh consecutive month when revenues have stayed over Rs. 1.40 L Crs.

CPI inflation declined to 6.8% in October from 7.4% in September, owing to increased food costs. WPI inflation has also continued to fall, with the Oct 22 print coming in at 8.4%, down from 10.7% in September. IIP increased by 3.1% on September 22 compared to - 0.7% in August 22.

In November, the PMI for Manufacturing and Services extended as well. In November, both the manufacturing and services PMIs were among the highest in the world.

On currency front, November saw some strengthening in rupee vs dollar as stronger-than-expected growth data gave further leeway for the RBI to continue its rate-hiking cycle with a more aggressive rate hike.

Conclusion

Earnings for Q2FY23 were broadly in line with expectations, led by Financials' sustained excellent performance and lower-than-expected losses in OMCs. Earnings growth for the Nifty increased by 9% year on year, fueled by BFSI. Profit, excluding BFSI, decreased 3% year on year. The overall performance was hampered by a significant drag from global commodities such as metals and oil and gas, which showed YoY profit declines of 67% and 29%, respectively.

According to commentary from various management, H2 looks solid in terms of demand, and margins are expected to improve as the commodities cycle cools. The good news is that foreign flows have largely stabilised, suggesting that relative strength in our markets will continue. Despite the index reaching all-time highs, small and midcap stocks remain below their prior year's highs. This provides an insight of the broad-based rally, as well as projected stock-specific performance given existing profitability and growth drivers.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.