Date: 17 Aug, 2023

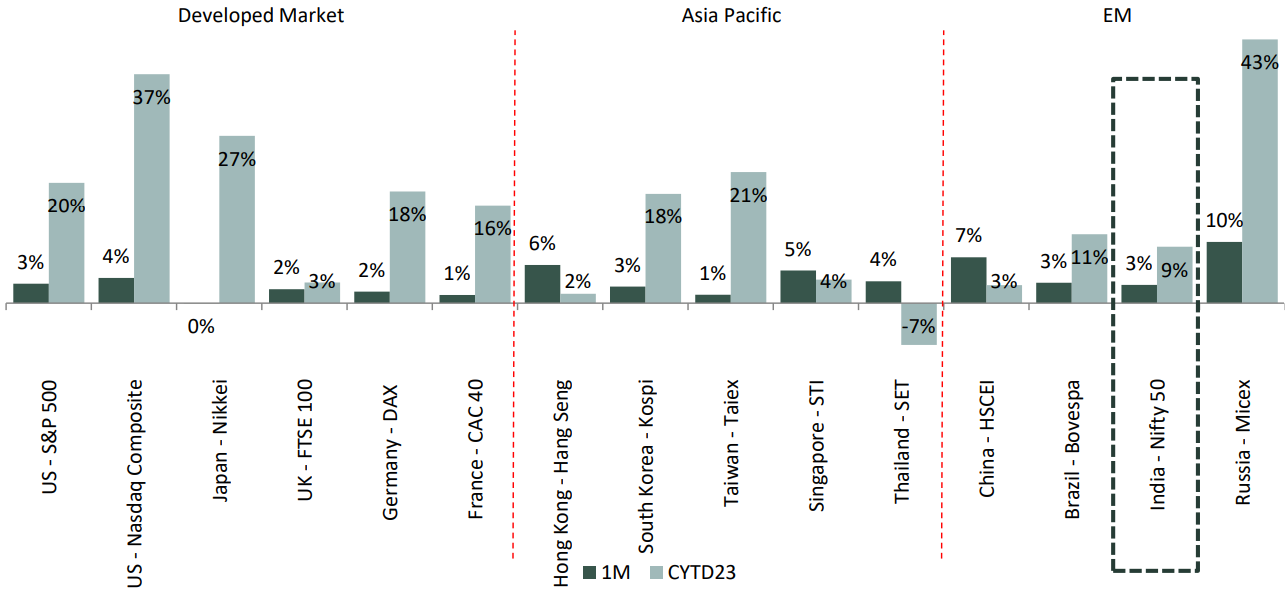

Nifty continues its winning streak: For the 5th consecutive month nifty closed higher closing at 19754 up 565 point (2.9% MoM) for the month of July 23. Nifty index till date is up 9.1% for CYTD23 and 13.8% for FYTD23. While broader markets continued to outperform benchmark indices i,e, Nifty Midcap 100 /Nifty Smallcap 100 outperformed Benchmark index by 2.6%/5.1% in Jul’23. Similarly, in CY23YTD, midcaps/smallcaps indices have outperformed largecaps and both have risen 20% vs. a 9% rise for the Nifty.

Rally had been broad based that none of the broader sector indices as indicated below showed negative returns for second consecutive month in a row.

Source: B&K Securites

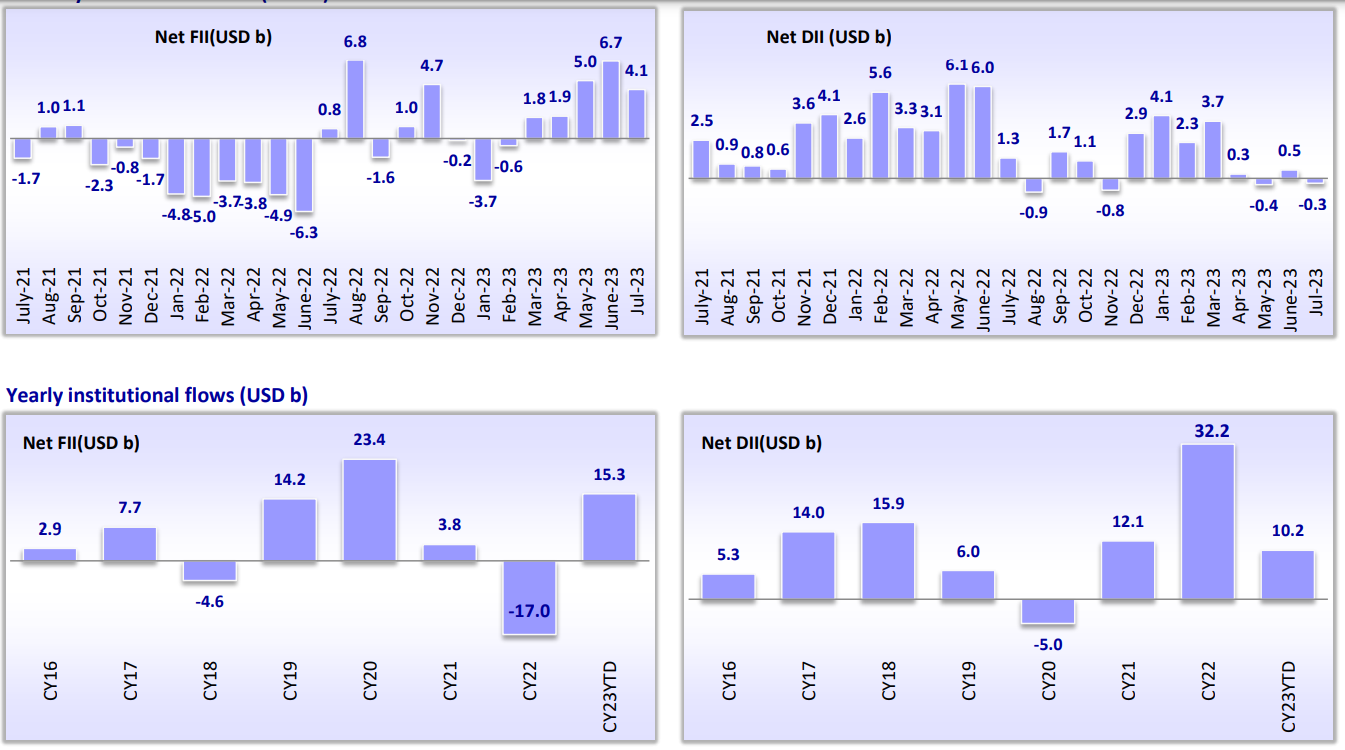

Flows: FIIs remained net buyers for the fifth straight month at $4.1B in Jul’23; YTD inflows stood at $15.3B propelling Index to a record peak levels above 19753. DIIs turned net seller in Jul’23 at $0.3B, with YTD inflows at $10.2B.

Source: MOSL

Source: MOSL

Global: Internationally, in line with market expectations, US Fed hiked rates by 25bps in its Jul’23 policy meeting, thus taking the benchmark rate to 22-year high of 5.25-5.5%. Steadiness in economic activity (GDP growth), “robust” job additions and “elevated” prices, pushed Fed to hike rates. Bank of England (BoE) also in its Aug’23 policy meeting decided to lift the key policy rate by 25bps to 5.25% from 5% earlier. Growth across regions seems to be losing steam with both manufacturing and services activity wavering. Within manufacturing, Eurozone has been the most hit, followed by US and China. Drop in new orders and export orders has impacted production and employment. US CPI inflation for June came in at 3%, directionally moving towards FED comfort zone of 2%.

Source: IDBI Capital

Corporate earnings in line so far: The 1QFY24 aggregate earnings have been in line with market estimates. Profits of the 33 Nifty companies that have declared results as of 31st July 23 have risen 43% YoY, fuelled by Tata Motors, BPCL, HDFC Bank, ICICI Bank and Axis Bank. These five companies have contributed 93% to the incremental YoY accretion in earnings. Tata Steel, Reliance Industries, and UPL have contributed adversely to Nifty earnings. Sectorally, earnings growth was propelled by domestic cyclicals, such as BFSI and Auto.

Monsoon Update: The cumulative rainfall as of 2nd August is 4% above normal. Almost 68% of India’s districts have received normal or excess rainfall as of 5th August with 29 out of 36 sub division having received normal or excess rainfall. Even as monsoon has moved to surplus zone, its distribution is uneven with North receiving excess rains while East have received deficient rainfall.

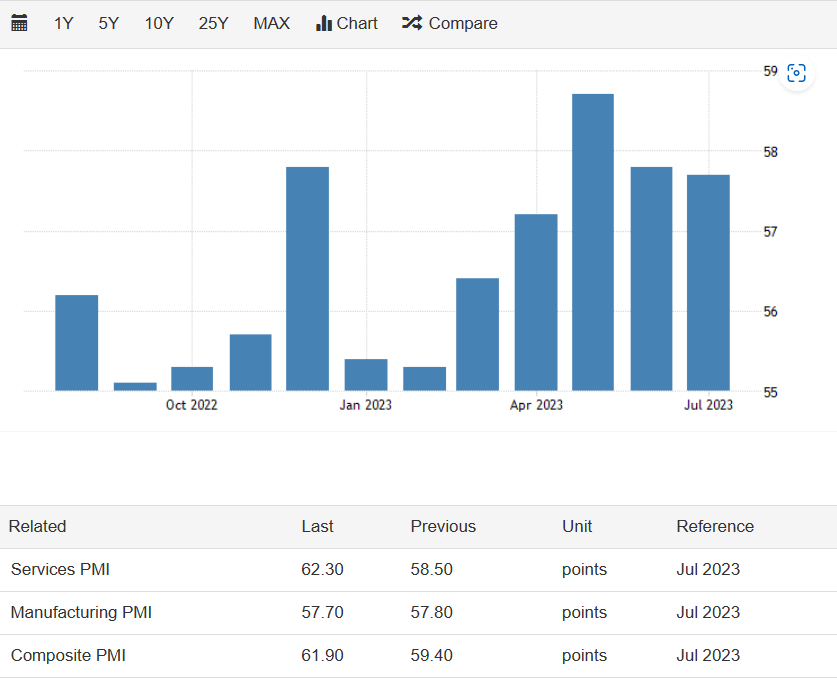

PMI : The S&P Global India Manufacturing PMI ticked lower to a 3-month low of 57.7 in July 2023 from 57.8 in June. Still, the latest print was above market consensus of 57.0, pointing to the 25th straight month of growth in factory activity.

Source: Trading Economics

Currency: The Indian rupee weakened to 82.8 per USD, approaching the record low of 83 per USD that was repeatedly tested on various occasions since October 2022 as fiscal concerns in the US triggered a flight to the dollar and exacerbated ongoing outflows of capital from the Indian economy. The rupee received pressure from high crude oil prices, while rupee has repeatedly tested record lows since the fourth quarter of 2022 before intervention from the RBI halted further depreciation.

Yield: The yield on the Indian 10-year government bond surged past 7.1%, the highest in three months, tracking the upward momentum for bond yields in the United States amid the hawkish momentum for central banks worldwide. A batch of strong economic data from the US strengthened the case for the Federal Reserve to maintain its funds rate at a restrictive level for a prolonged time, pressuring Treasury prices. Domestically, upside risks to retail inflation continued to pin bets that the RBI will refrain from lowering interest rates in the near future, triggering a sharp G-Sec selloff since the start of June.

GDP: India GDP expanded by 7.2% in the 2022-23 fiscal year ended March 2023, slightly higher than 7% in the second estimate, and also above 7% in the government’s forecast. For the 2023-24 financial year, the central bank projects GDP growth at 6.5%. source: Ministry of Statistics and Programme Implementation (MOSPI)

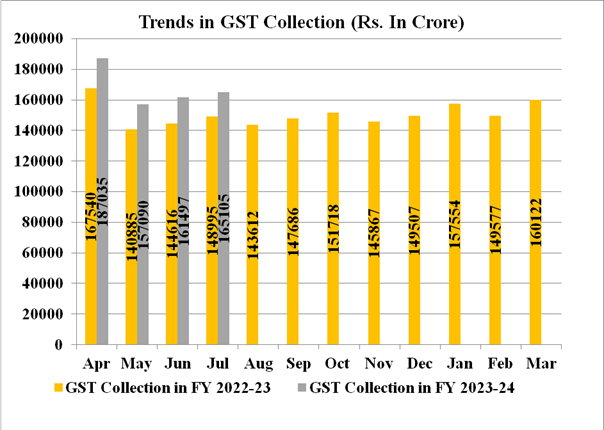

GST: The gross GST revenue collected in the month of July, 2023 is Rs.1,65,105 crs. During the month, the revenues from domestic transactions (including import of services) are 15% higher than the revenues from these sources during the same month last year. It is for the fifth time, the gross GST collection has crossed Rs. 1.60 lakh crore mark.

Source: PIB

Portfolio Manager Commentary:

Equity market continues to scale new highs on the back of the optimism surrounding the Indian economy. Alternatively, Goldman Sachs recently came out with a note which indicated India to become the second largest economy by 2075. Through our YUVA Bharat PMS strategy, we endeavour to participate in India growth story.

Equity markets after remaining range-bound over the past 20 months, has finally broke out of range and surpassed the previous highs in Jul’23. While markets optically are at all-time high, while in terms of earnings during the same period from FY21 to FY23 nifty earning has expanded from Rs. 542 to Rs. 807 a CAGR of 22% over the same period, thus on relative basis valuation are relatively reasonable compared to Oct 21 peak. Nifty currently is trading at 24.5x, while on forwards basis at 20.8x (FY24E Nifty EPS Estimate 950) marginally higher than 10-year average of 20%. Looking at overall flows, momentum in economic activity (PMI, GST, GDP) along with expectation of rate cut by 4QFY24 markets tends to move towards 1SD up 22.4x. However, we keep cognisance of global concern on inflation and rates, Ongoing conflict between Ukraine and Russia and Monsoon spread and Agriculture sowing data. We believe Time in market is more important than timing the market from long term wealth creation.

Source: MOSL

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.