Date: 11 Apr, 2023

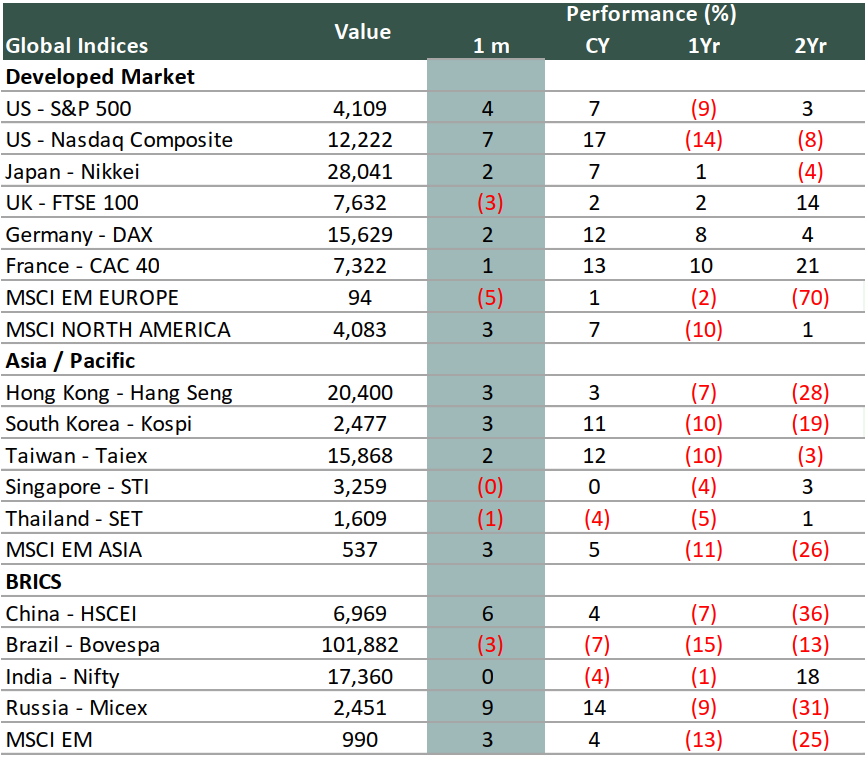

March month that went by was quite an eventful one. Three non-major banks in the US were forced to file for bankruptcy due to mark-to-mark losses. (Amidst weak risk practices). Before the Swiss government agreed for a takeover by UBS, Credit Suisse was on the verge of bankruptcy in Europe. Despite this, the US market, represented by the S&P 500, rose +4% MoM on March-23. With lessening worries about the global financial system and positive reports on Chinese manufacturing, services, and construction activity, Asian markets followed Wall Street in terms of investor mood. China saw sharp recovery at 6% after fall in February.

World Indices % Performance in March 2023

1- Source: IDBI Capital, Bloomberg

Economic activity in the Eurozone (EZ) is improving, with the composite output index rising to 53.7 in March-23 (the highest since May-22) from 52.0 in February-23. On the inflation front, the main CPI index fell to 6.9% in March-23, down from 8.5% in February-23. The drop in energy costs was fueled by a drop in worldwide oil prices and government subsidies. However, core inflation remains a major source of worry.

In the midst of market turbulence, the US Fed raised its main policy rate by 25 basis points at its March-23 policy meeting, bringing the total hike to 450 basis points. However, given evidence of slowing economic growth, the Fed is projected to terminate its tightening rate cycle and take a pause at its next policy meeting. The Fed now anticipates GDP growth to drop to 0.4% in CY23, down from 0.5% previously anticipated. Similarly, Bank of England also in accordance with market forecasts lifted its rates by 25bps, raising the overall hike to 350bps.

The Reserve Bank of Australia (RBA), a prominent global central bank, has declared a halt, interrupting a streak of ten consecutive rate rises.

In Asia, both Japan and China have maintained loose monetary policy. The Bank of Japan has also announced an expansion in the scope of its scheduled bond purchases in Q2CY23. It will now purchase ¥100bn to ¥500bn of 10Y-25Y bonds every operation, up from ¥200bn to ¥400bn in Q1. The PBOC also stunned markets by announcing an unexpected reduction in CRR (-25bps) for almost all banks (excluding those with a reserve ratio of 5%).

Domestically, the optimism shown in global markets was not seen in Indian markets, as the index closed the month of March flat. Our markets have remained flat in CY23 after outperforming peers over the previous two years. On the plus side, FIIs became net purchasers in Mar-23, aided by capital movement into Adani group equities.

Some notable releases during the month were:

To summarize, the Indian stock market saw a roller-coaster ride in the financial year ending March 2023, amid strong monetary policy stances by global central banks, outflows of outside capital, soaring inflation, and the Russia-Ukraine war. Despite the fact that FIIs sold $5.7 billion in shares, DIIs backed with a net purchase of $31 billion. We feel that the current 10% pullback in the Nifty from its all-time highs has provided an excellent chance for investors to accumulate equities for the long term at reasonable prices.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.