Date: 15 Sep, 2022

Opening

Market strength continued in August, with indices reporting positive returns for the second month in a row. Volatility was elevated as global markets reversed dramatically near the end of the month, fuelled by increased expectations of sharp interest rate rises and a corresponding surge in US 10-year Gsec rates. The Dollar Index also reached a record high, sparking another wave of risk-aversion internationally. Despite this, Indian stocks outpaced major global markets. The NIFTY50 finished the month up 3.5%, but the S&P BSE Mid-cap and S&P BSE Small-cap 250 indexes beat large-cap indices.

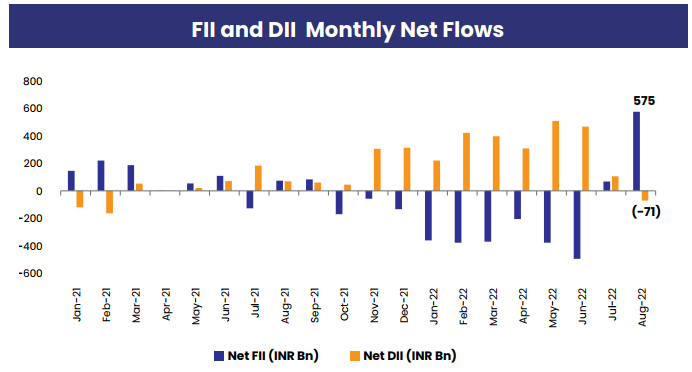

The resumption of FII inflows also contributed to market strength. After ten months, FIIs became net purchasers in August'22, totalling $6.8 billion (16 month high). DII’s who were the backbone of liquidity all along, chose to book profit for the first time in last 15 months to the tune of $890M.

RBI raised the repo rate by 50 bps to 5.4%. Helped by favourable base, India’s GDP rose strongly by 13.5% in June’22 quarter. GST Collection rose 28% to Rs. 1.43 L Crs in August’22 and have remained over the Rs. 1.40 L Crs mark for the sixth straight month.

Figure 1 Source Bloomberg, Axis Capital

Earnings

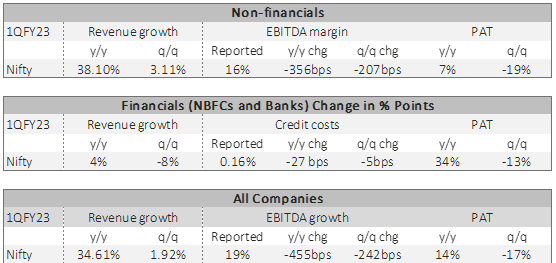

Figure 2 Source Spark Capital The 1QFY23 earnings season was largely positive, reinforcing the market's upward trend.

The 1QFY23 earnings season was largely positive, reinforcing the market's upward trend.

Top-line growth was robust, but hampered by a weak base. The two-year CAGR is still slightly low, indicating that the economy has most likely not recovered fully from COVID. We believe that the trend would continue to strengthen through FY23, owing to robust consumer demand and continuing capex rebound.

Margin pressures persisted in this quarter. From here, things should start to improve. The worst of the commodity price impact appears to have been absorbed across two quarters in 1HCY22, with companies responding with a combination of cost-cutting and pricing increases. That cycle appears to be coming to an end.

Financial results were particularly strong. Top-line growth and revenues have rebounded, although credit costs have been unusually low, given the risk aversion since the pandemic and substantial provisioning through FY21/FY22. PAT growth was hampered by one-time bond losses, but it should begin to normalise in 2QFY23.

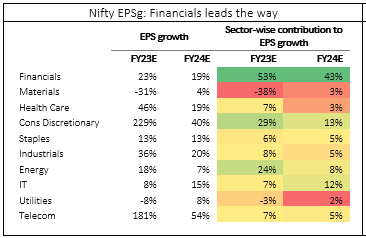

Figure 3: Source: Ambit Capital

Currency

The major cause of weakening is the US Fed's tightening. The Fed funds rate has already been hiked by 225 basis points in CY22, with a further increase expected before the end of the year. The RBI has hiked rates, but it is unlikely to stay up with the Fed, causing the rate differentials to expand even further. This will put extra pressure on the currency, but we do not believe it will be decisive. The dominance of equities in India's foreign capital flows (55% from FY18 to FY22) protects the rupee from being too vulnerable to rate differentials.

Crude prices have fallen 36% from their early March highs, providing some respite to India's prospective current account deficit.

Exports are certainly benefiting, and the IT sector is one of the major beneficiaries. However, there are certain cross-currency headwinds that might diminish the gains, so the flow-through is not linear. Companies also have varying hedging procedures, so gains are often realised with a lag. The devaluation reduces profitability for most consumer and manufacturing industries.

Domestic companies lack natural hedges against imported raw materials (RM), making them sensitive to a weak rupee. However, in this cycle, the rupee had only a minor role; the rise in underlying RM costs was a major culprit in pulling down margins. If global commodities continue to rise, the weak rupee will have little impact on importers.

We anticipate that India's economic growth will stay robust as the impact of "opening up" and the revival in the informal economy fuel the momentum. Unfortunately, Indian consumption remains import-intensive, putting some strain on the current account deficit.

View

Over the last few months, Indian stocks have demonstrated extraordinary resiliency. This is especially significant considering the ongoing volatility in global markets. On the economic front, India has stood out, with GDP growth expected to remain over 7% in FY23, in a world where nations are trying to avoid recession. The increased potential for Indian manufacturing as a result of the China+1 move, as well as the increased competitiveness of Indian enterprises due to high electricity prices elsewhere in the globe, contribute to the confidence. Domestic demand is expected to be quite robust in the coming festival and wedding season, which will be the first regular one in three years following the Covid-related shutdowns.

While we continue to expect that Indian stocks would outperform most global markets in the short term, we remain bullish on the markets in the medium term and feel that, despite market strength, there may be some short-term turbulence. We continue to screening ideas and prefer to "follow the earnings" approach rather than bet on a broad market comeback. We feel that off-index equities are more likely to deliver and are focused on ideas with appropriate risk trade-offs.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.