Date: 20 Dec, 2021

ICICI Securities Ltd (ISEC) is our bet on rising interest in retail participation towards Indian Equity markets along with bet on increased financialization supported by ISEC’s relatively larger base of affluent clients including retail and HNIs vs peers to whom it can cross sell its wide bouquet of investment products. This was picked by our fund Rockstud Capital Investment Fund Series I around Rs. 350–400s and we are currently riding multibagger (2x) returns on it over a 1 years’ time.

Company Brief — ISEC is one of the largest and oldest bank backed brokers in India and ranks 1st in client base of 4.7mn and #2 in active client base (1.4mn) having 10% market share and #2 in market volume. All this is despite the rise of discount brokers however margins were impacted to some extent. Apart from broking it has plethora of financial products like mutual funds, life and general insurance and 3rd party loan products. It stands leader in distribution ranking 2nd with market share of 9.4% as of FY21. The Company has one of the largest pan-India distribution network of around 200 ICICIdirect offices in over 75 cities, 7,100+ sub-brokers, authorised persons, Independent Financial Associates (IFAs) and Independent Associates (IAs). As on March 31, 2019, the Company distributed over 2,400 mutual fund schemes.

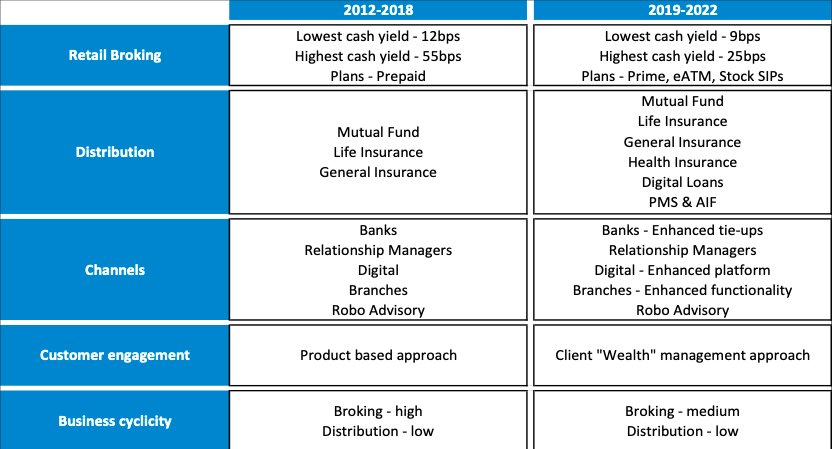

ISEC has taken radical business transformation over the years and due to that, its future looks more stable and less cyclical to become one stop shop for all financial needs.

Why we bought — Apart from financial parameters that we run across on quant below are some of the highlights which caught our attention for our investment.

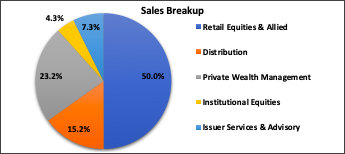

· Firstly, well diversified business and creating granular revenue streams to reduce revenue cyclicity — ISEC derives its revenues from various avenues including brokerage income and services mainly distribution income, interest income and investment banking. In the process of disruption led by financialization, management looks to achieve customer stickiness and granularize revenue to minimize the impact of volatility. With the advent of change in customer demographic data, it suggests the population of new young generation is going to remain key driver for steady revenue growth. ISEC continues to focus on improving its cross-sell ratios thereby reducing cyclicity of revenues. Currently, no of customers having subscribed to 2 or more products stand at 1.9m vs 0.8 a year ago. Its constant endeavor remains to elevate this ratio and thus continues to invest heavily in analytics-based technologies to speed up acquiring customer’s journey faster. To address gamut of different clients under broking business, management with help of technology has taken initiatives like introducing plans like “Prime”, “Pre-Paid”, “Neo”, amongst others. These initiatives are already showing green shoots in its core business. Post success of ISEC’s decision to adopt open architecture concept to acquire and cater new clients under broking business, they have similarly adopted the same strategy for distribution of life insurance products. Under this, ISEC distributes life insurance products for both ICICI Pru Life as well as HDFC Life and plans are to further add-on new partners going ahead to improve income from distribution. ISEC also forayed into distributing health insurance products.

· Secondly, optimizing operating costs and focus on growing digital capabilities — As a part of its long-term strategy, ISEC plans to reduce dependency on physical model and push towards widening its digital infrastructure. ISEC reduced its branch count from 218 in FY14 to 148 in FY21. However, they do not expect the branch count reduction to be aggressive here-on. The management expects opex growth to remain tepid in the near to medium term. A major part of the opex would include investment in enhancing the technology platform along with higher spends on marketing ISEC’s products. Currently, the mix of fixed to variable expenses stands at 60:40 and the company will look to ‘variable’-ize its expenses and improve the share of variable expenses thus exercising control on opex in times of volatility.

· Thirdly, ISEC’s strong brand name to well encapsulate given industry tailwind — Given existence of group for more than 2 decades and have seen various market cycles it has strong hold in capital markets. The brand ICICI Securities is well established among retail & institutional investors in India. Besides this the company is a subsidiary of ICICI Bank which holds a 77% stake in the company. This gives access to the bank’s retail clientele, its branch network and the physical presence. It has also entered into unique arrangement with ICICI Bank to facilitate higher activation rate and improve the quality of customers, acquiring from more affluent and relevant segments. The bank helps company in targeting NRI customers by sharing digital leads with overseas branches of the banks and leveraging 20-minute tab-based instant account opening process for pre-existing bank customers. Further, because of COVID-19, there has been a wild swing in the market and that has brought a large volume into the Indian stock market. Investors opened 14.2 million new demat accounts in FY21 according to SEBI data nearly 3x to FY20 data. This trend shows that many young investors are getting attracted by the volatility and looking to trade/invest. In fact, India has a favorable demographic such as low penetration, rising household saving, increasing financial literacy etc. This shows that a multiyear growth story lying ahead of them.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.