Date: 18 Jan, 2022

Canara Bank Ltd (CAN Bank) is our contra bet on improving operational fundamentals of the bank led by green shoots of growth in the economy and having relatively better book versus its peers in that size. This was picked by our fund Rockstud Capital Investment Fund Series I around Rs. 150–170s and we are currently a +30% returns on it over a 9 months’ time.

Company Brief — Canara Bank is mid-sized well managed PSU bank with headquarters in Bangalore. The Bank operates in four segments namely treasury operations, retail banking operations, wholesale banking operations and other banking operations. The Bank provides a range of products and services to the customers. Canara Bank has a strong pan India presence and as on 30 Sep 2021 it has 9,804 branches and 10,988 ATMs catering to all segments of an ever-growing clientele accounts base of 10.90 Cr. Across the borders, the Bank has 8 branches one each at London, Leicester, Hong Kong, Shanghai, Manama, Johannesburg, New York, DIFC (Dubai) & a Representative Office at Sharjah UAE.

Why we bought — Apart from financial parameters that we run across on quant below are some of the highlights which caught our attention for our investment.

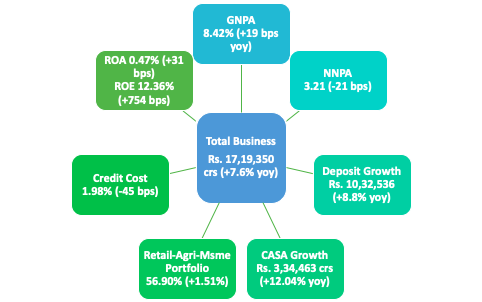

· Firstly, Major NPA issues were largely resolved & green shoots of QoQ improvement seen– On frontline basis, NPAs saw a serious improvement i.e. from 11.84% to 8.42% i.e. 340 bps improvement in last +3 years on gross levels whereas on net it improved from 7.48% to 3.21% i.e. 427 bps. Provision coverage in the same period improved from 58% to 82.4% whereas Slippages recorded improvement from 7.73% to 1.04%. Key factors that led to such a performance was improved cash recovery on average ~Rs. 7,000–8,000 crs per year with improved credit costs ~1.9%. Lumpy corporate accounts and NCLT recoveries from likes of Bhushan Power & Steel, UB group, DHFL, etc. supported on profitability fronts which management again utilized to provide for future NPAs as an act of prudency thereby insulating any major shocks in NPA movements for future quarters. Total Business (Advances+Deposits) in the same period showed ~19.3% CAGR growth.

· Secondly, stronger parentage i.e. subsidiary values superior than peers — During our research we analyzed subsidiaries of peer banks to understand any value unlocking potential exists in PSU banks led by non-core investments or on subsidiary level. Can Bank was compared with other peers like Union Bank of India, Bank of India, Indian Overseas Bank and Indian Bank for the same. Upon findings, Can Bank’s one of the major subsidiaries were Canara Robeco Asset Management Co, Canara Bank Securities, Canara HSBC OBC Life Insurance Co, Can Fin Homes (one of our invested companies) and three Gramin banks i.e., Karnataka, Kerala and Andhra Pragati. These compared to other banks were not only superior but as per management, there’s an intent to divest these subsidiaries at right valuation to spur up the capital that’ being needed for growth.

· Unfavored contra bet at market’s peak — PSU banks have always been talked about in past about factors like its relevance today in comparison to private banks and new age fintechs, legacy issues in regards to asset quality and poor management that runs such legacy banks. Many such reasons have always led to deep discounting of valuations when compared to private counterparts and general perception has been to avoid these for an investment portfolio. Our thesis is, valuations always move towards its mean over a long-term period (either premium or deep discounted) for any given stock based on the operational performance. Our assessment of consistent improvement in QoQ performance and divergence of valuations by ~30–35% to its average P/B gave us confidence to take a bold yet contra bet on Canara Bank when markets reached its peak and were averse to the idea of investment in PSU banks.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.