Date: 03 Dec, 2021

Can Fin Homes Ltd was our bet on factors that growth in housing sector until 2012–13 had been sluggish with piling of debt on balance sheets and subdued demand and demonetization along with RERA creating a standstill in announcement of new residential projects. However, government’s “Housing for All” by 2022 mission has provided much needed boost to this troubled sector and created opportunities for niche housing finance companies with strong presence in Tier 2–3–4 regions to tap growth in years to come. This was picked by our fund Rockstud Capital Investment Fund Series I around Rs. 350–400s and we are currently riding it by +60% in less than a 1 years’ time.

Company Brief — Can Fin Homes Ltd (CanFin) is a small cap housing finance company promoted by Canara bank with shareholding of 30%, based out of Bangalore, India and it is present under affordable housing finance segment. It has around 24 products under portfolio both under housing and non-housing tailor made for niche customer segment across 186 branches and 14 satellite offices. Key regions it caters to is South India i.e., Karnataka, Andhra Pradesh, Tamil Nadu, Telangana which comprises of 65–70% of its total loan book.

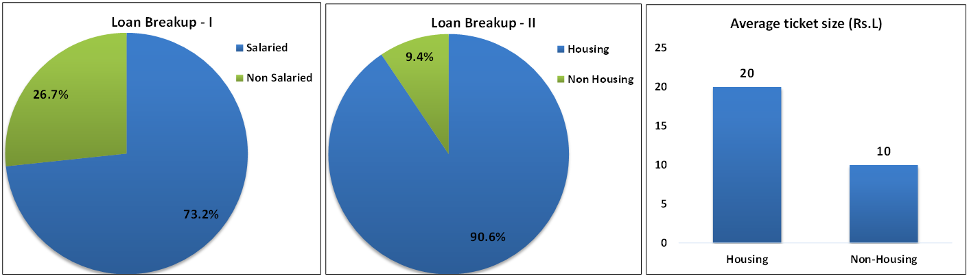

Loan Profile

Why we bought — Apart from financial parameters that we run across on quant below are some of the highlights which caught our attention for our investment.

· Firstly, firm steps from government to focus on ownership of house for its citizens — Some of the key steps taken by government include (a) Tax incentives for first time home borrowers for low ticket purchases reducing effective yield from 9.5% to 4% and lower, (b) granting affordable housing a infra status, © various government schemes like Housing for All by 2022 (Pradhan Mantri Awas Yojna), Smart Cities Mission, Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and RERA to make sector more transparent, (d) Increased funding sources with ECB for affordable housing, masala bonds and enhancing investment limits for insurance companies for high rated HFCs (e) Extension of deadline for CLSS-MIG scheme under PMAY by one year upto Mar 2021, (f) additional tax deduction of upto Rs. 1.5L for interest paid on housing loans sanctioned in current fiscal for homes priced below Rs. 45L (g) Stamp duty cuts in various states, (h) Allowing one time restructuring of real estate projects and extension of DCCO for commercial projects by one year, etc. These factors played a strong ground up for a sustainable yet rise to volume growth in realty space especially in affordable housing segment.

· Secondly, several macro factors are at play that create huge opportunity for housing credit demand — Housing finance is a strong multiyear growth opportunity and some key factors supporting underlying housing credit demand are: 66% of India’s population below 35 years of age indicating strong underlying generic demand, shift towards nuclear family setup from joint family structure, urbanization trend i.e. % of Indian population living in urban areas to move from 28% to 45% by 2024, improving affordability with higher disposable income fueled with additional support from low interest rate regime (300bps lower than 5 years ago) and mortgage penetration in India standing at ~9% vs global average at 19%.

· Thirdly, CanFin’s inherent strength vis-à-vis its peers made it a clear choice for us — At a time of our investment, CanFin’s cost of borrowing stood ~7.8% vs other key HFC players at 8.1–8.8% given its parent i.e. Canara bank is important part of PSU eco system and has ample access to cheap funding lines with cost of bank borrowing standing ~20%. Its underwriting process were not only well defined but also stringent all throughout its growth phase i.e. loan breakup between salaried:non salaried and focusing majorly towards housing loan unlike other players who diverted towards LAP, builder loans which does yield higher but pose higher risk as well which CanFin was majorly insulated with. Its operating costs i.e. Cost to Income ratio was one of the lowest vs peers supported by better deal sourcing through direct sales agents ~46% of fresh disbursals.

Disclaimer — The article is made for informational purposes only and should not be regarded as an official opinion of any kind or a recommendation. It does not constitute an offer, solicitation or any invitation to public in general to invest in the stocks discussed. This article is confidential and privileged and is directed to and for the use of the addressee only. The recipient, if not the addressee, should not use this material if erroneously received, and access and use of this material in any manner by anyone other than the addressee is unauthorized. It shall not be photocopied, reproduced or distributed to others at any time. While reasonable endeavors have been made to present reliable data in the article, Rockstud Capital LLP does not guarantee the accuracy or completeness of the data in the article. Prospective readers are cautioned that any forward-looking statements are not predictions and may be subject to change without notice. No part of this material may be duplicated in any form and/or redistributed without Rockstud Capital LLP’s prior written consent.