Aditya Birla Capital (Abcap) is our bet on revival of economy as and when it unlocks from post Covid 19 shocks, the pace of credit offtake regaining its momentum led by pentup demand and management’s plan to provide value unlocking to its shareholders over a period of time. This was picked by our fund Rockstud Capital Investment Fund Series I around Rs. 110–120s and we are currently a +18% returns on it over a 10 months’ time.

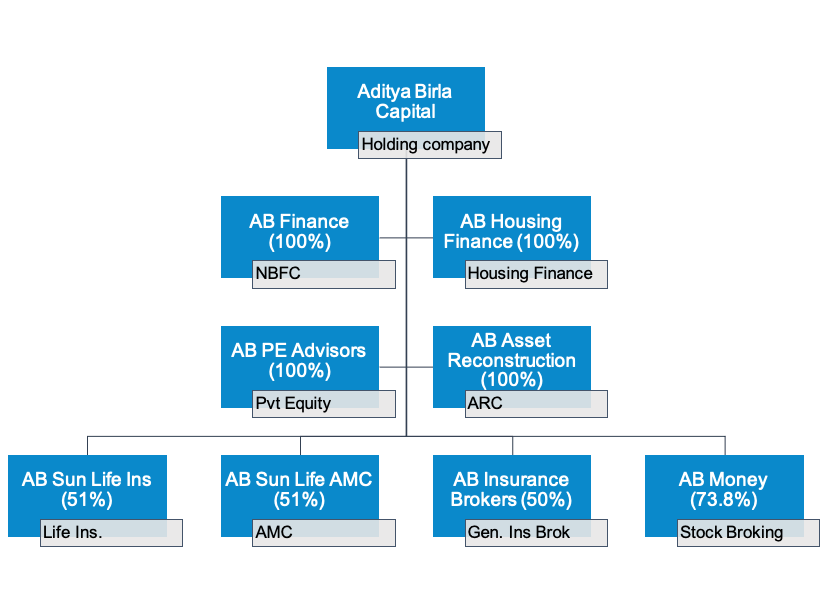

Company Brief — Aditya Birla Capital Ltd (Abcap) is one of the largest and diversified NBFC in India. Formerly known as Aditya Birla Financial Services Limited, Abcap is the holding company (received CIC license on 16th October 2015) of all the financial services businesses of the Aditya Birla Group. Its business spreads across life insurance, asset management, private equity, corporate lending, structured finance, general insurance broking, wealth management, equity, currency and commodity broking, online personal finance management, housing finance, pension fund management and health insurance businesses. Though each business is run independently, Abcap plays crucial role of providing strategic direction, technology integration, ecosystem reach and partnerships etc.

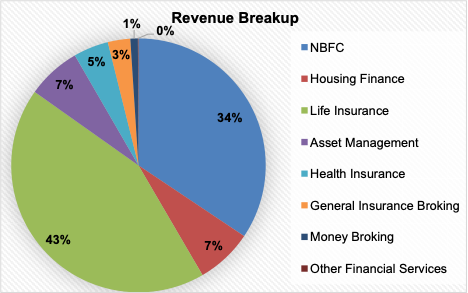

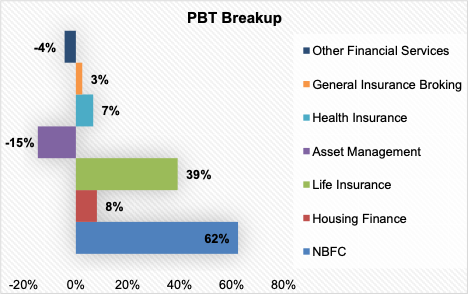

AB Cap’s Revenue & Profitability mix

Why we bought — Apart from financial parameters that we run across on quant below are some of the highlights which caught our attention for our investment.

· Firstly, lending business continues to remain the key cash cow for the firm — Abcap’s two of its flagship businesses are NBFC and Housing finance (HFC) verticals. Its NBFC business is one of the largest diversified with AUM of ~ Rs. 48000 crs whereas its HFC business commands ~ 12000 crs. Both the business’s have industry leading margins i.e. NIMs ~4–6% with contained asset quality i.e. GNPA at ~1.5% and NNPA at ~1%. Going ahead strategy is to continue to build granular book by reducing average ticket size and also introduce newer products in small ticket size both secured & unsecured loans to not only help with diversification of loan profile but also improve yields. This over time can kick in operating leverage led by expansion, stepping up distribution franchise, growing digital pie of business and in return boost return ratios. A strong parentage as well as comfortable liquidity poses strategic cross-cycle advantage to Abcap.

· Secondly, Emerging business to spur growth — While lending businesses continues to do well, their other emerging businesses like Life insurance, Health insurance, ARC, General Insurance are under investment/growth phase. Given comfortable cash position to fuel growth, strong parentage and its existing customer base across other businesses acts as support for cross selling opportunities. Plans for insurance businesses is to grow its pie of protection business and health businesses from ~5–6% to 12–14% over next 3–4 years. Explore launching new products, increase tieups and partnerships for distribution and achieve operational leverage over a period of time which in turn improves return profile.

· Thirdly, value unlocking of business verticals remains key trigger — There’s an inherent yet natural inclination of group to explore for probable value unlocking of its businesses over a period of time in the need of investments to achieve a significant degree of at par scale vs competitors. Their AMC business recently saw a listing as guided by management and its probable their other well-established businesses i.e. NBFC and Housing finance businesses would be in next line for similar listing. We believe the intrinsic value of individual businesses given the scale and profitability would supersede the current prevailing price with successful value unlocking.

· Fourthly, Well structured to fuel group’s banking aspirations in future — Given the structure of Abcap is core investment company (CIC), it acts as non operating financial holding company (NOFHC) for all the financial businesses at group level. This structure of NOFHC was one of the precursor under RBI’s 2013 “universal banking” norms. Group has all the relevant regulatory requirements in place i.e. governance, ownership structure, regulatory ring fencing perspective. Currently, Abcap is awaiting an RBI’s internal working group’s final recommendations before taking call on pursuing banking license.